A failed low-carbon transition could wipe 33% off pension fund returns worldwide by 2050 in a high warming climate scenario that tracks the current trajectory of global warming. The outlook deteriorates further when adjusted for inflation.

New analysis by Ortec Finance applies its proprietary 2025 climate scenarios to the investment portfolios of 180 pension funds across the six largest global pension systems, revealing the consequences of further delaying the net-zero transition.

By 2028, the average impact on nominal pension fund portfolio returns is modest at 2%, widening to 6% in 2035 and deepening to 33% in 2050.

Dual-headwinds: threat to economic growth and risk of climate-induced inflation

Climate change is set to reshape global GDP growth expectations by disrupting the fundamental drivers of economic stability. Both transition and physical risks directly affect growth, inflation, and long-term financial stability, with implications for pension funds and the wider economy.

In a high warming scenario, unaddressed climate change could push global GDP over 10% below current expectations by 2050.

Projections beyond 2050 show further deterioration where developed economies risk GDP growth stalling completely between 2050 and 2075.

Rising temperatures, heat stress, and reduced agricultural productivity drive persistent inflation, which challenges monetary policy and threatens price stability. In the United States, inflation expectations could rise by 0.7%, a material increase given the historical 2.5% average since the early 2000s.

By contrast, a Net-Zero (NZ) transition helps preserve GDP growth by recycling carbon revenues, boosting investment and consumption, and containing physical risks. The choice between orderly transition and economic disruption is stark.

Long-term outlook much better under successful transition

Transition scenarios show that a successful transition to a low-carbon economy results in a much better long-term outlook for pension fund returns, despite causing steeper drawdowns in the short-term.

“By 2035, performance of the global pension portfolios under high warming scenarios is already worse than under the worst-case transition scenarios, highlighting the catastrophic implications of not transitioning,” says Doruk Onal, Climate Risk Specialist at Ortec Finance.

By 2050, the gap almost completely reverses, with the high warming scenario showing 33% declines compared to only 8% in a delayed net-zero or 4% in a net-zero financial crisis scenario. When inflationary pressures are factored in, the outlook becomes even more concerning, as real returns suffer an even steeper erosion, especially under the high warming scenario.

Traditional diversification must incorporate geographical exposure to climate change

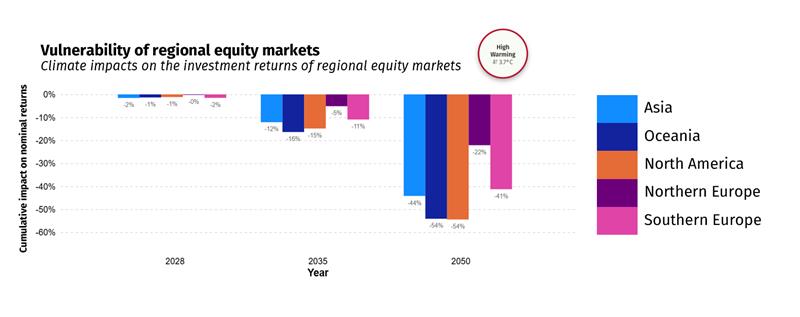

“Climate change is systemic, but it does not impact all geographies equally. If superannuation funds are to mitigate climate risk, they must rethink strategic asset allocation to incorporate geographic variation,” said Maurits van Joolingen, Managing Director, Climate Scenarios & Sustainability at Ortec Finance.

Investment decisions that rely solely on traditional metrics risk overlooking the climate risks embedded in regional exposure. Home bias, inherent in domestic pension fund investing, creates concentrated climate risk where home markets are disproportionately exposed to physical risks.

By 2050, equity markets in countries in Oceania, North America, Asia and southern Europe, are projected to underperform by between 41% and 54% in a high warming scenario, largely due to exposure to extreme weather events and resource scarcity. Northern Europe, by comparison, shows a smaller 22% decline thanks to cooler conditions and lower physical risk exposure.

Financial markets not pricing climate risk

The report notes that many physical risks that are uninsurable or irreversible, such as climate tipping points, remain underrepresented in asset valuations. This disconnect between current pricing and potential escalating physical risks leaves pension fund portfolios highly exposed to underestimated downside risks.

“This report clearly shows that the immediate costs of transitioning to a low-carbon economy are significantly outweighed by the long-term physical impacts and escalating costs of continued climate inaction. Climate change poses profound risks to global pension funds, but also a clear opportunity: an immediate and coordinated low-carbon transition offers the best long-term outcome. Delay, by contrast, risks stranded assets, higher inflation, and escalating losses. While no single pension fund can shift the global trajectory alone, the collective influence of institutional investors is substantial. Thus, pension funds play a key role in supporting the low-carbon transition for both financial security and societal well-being,” said Maurits van Joolingen.

Access the full report - Translating the cost of climate change for the global pension industry: 2025 update

To obtain the full analysis, download our report ‘Translating the cost of climate change for the global pension industry: 2025 update - A global and multi-asset class assessment using top-down climate scenarios’

Download report Climate Scenarios & Sustainability

Contact

Maurits van Joolingen

Managing Director, Climate Scenarios & Sustainability