Ortec Finance, a leading provider of technology and risk management solutions for financial institutions, has found that insurers must drastically rethink their approach to investment if they are to avoid catastrophic losses from climate change.

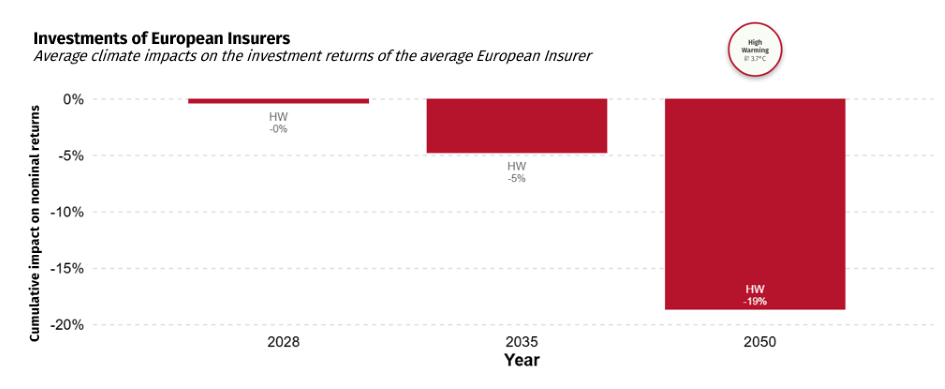

Their latest analysis, using its proprietary 2025 climate scenarios, shows that under the current high-warming trajectory, insurers are set to incur investment losses of up to 19%** (nominal) by 2050, with even greater losses in real terms due to persistent climate-driven inflation. These losses are largely driven by the accelerating impact of physical risks and inflation linked to climate change.

The resulting headwind of shrinking portfolio returns, rising premium costs and policy payouts threatens the viability of the insurance business model, potentially impacting the effectiveness of traditional risk-transfer methods such as reinsurance and rendering large swathes of assets uninsurable.

Insurers need to better understand the geographic impact of climate change across the balance sheet

Investment decisions that rely solely on traditional metrics, such as historical returns and market size, risk overlooking the climate sensitivity of regional exposure.

“For insurance companies, this means rethinking strategic asset allocation to include climate resilience. Home bias, often driven by familiarity, regulatory constraints, and perceived stability, can become a source of concentrated climate risk. Investment frameworks need to evolve to include regional climate sensitivities, infrastructure resilience, policy uncertainty and the limits of risk-transfer mechanisms such as reinsurance in portfolio construction,” said Maurits van Joolingen, Managing Director of Climate Scenarios & Sustainability.

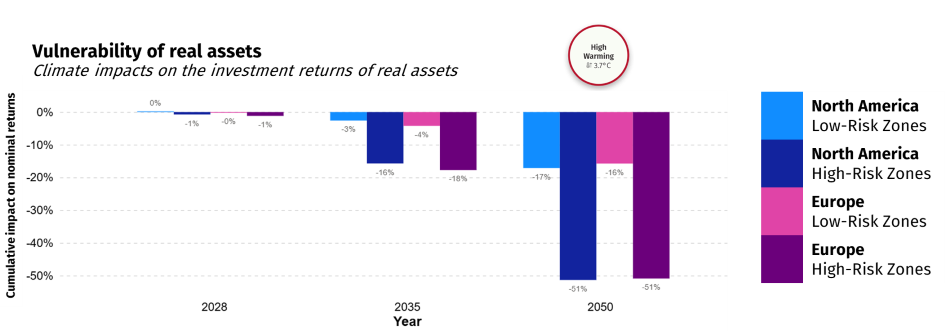

Moreover, climate risks do not have a uniform impact on the insurer’s balance sheet. The same global climate scenario can produce materially different outcomes depending on where assets are located, where risks are underwritten, and the line of business the insurance company is in.

Insurers typically favor holding diversified assets domiciled across regions with deep, liquid financial markets, while underwriting policies in a geographically concentrated manner. This behavior creates a gap between climate sensitivities of the asset and liability sides of the balance sheet, adding further complexity to insurers’ risk management. Catastrophic events can trigger large claims and depress local asset values, compounding losses when exposures are concentrated. While geographic diversification helps, its effectiveness is eroding as climate change links distant regions through shared vulnerabilities, making real estate a critical factor and warranting additional consideration to ensure their strategies remain resilient.

Pricing climate risk: a crucial missing link and significant opportunity

Many physical risks, especially those that are non-linear, uninsurable or irreversible, such as climate tipping points, remain worryingly underrepresented in current asset valuations. The disconnect between pricing and rising physical risk leaves portfolios exposed to unanticipated downside risks, especially for long-term investors such as insurers.

“While the pricing gap represents an area of risk for insurers, it also creates an enormous opportunity for them to better understand the entirety of climate risk so they can position their portfolios to benefit from a repricing over the long term,” said Doruk Onal, Climate Risk Specialist at Ortec Finance.

While the report provides a bleak outlook for insurance companies business models and investments if the world continues on its current high-warming trajectory, its transition scenario models, where the world successfully transitions to a low-carbon economy, paints a very different picture. In these scenarios, long-term gains of transition far outweigh the short-term costs by maintaining premium affordability, stabilizing policy payouts, and preserving business continuity through more stable macroeconomic conditions.

Access the full report - Translating the cost of climate change for the European insurance industry: 2025 update

To obtain the full analysis, download our report ‘Translating the cost of climate change for the European insurance industry: 2025 update - A multi-asset class assessment using top-down climate scenarios’

Download report Climate Scenarios & Sustainability

*Ortec Finance’s analysis is derived from an asset-only reference investment portfolio that reflects the average asset allocation of a European insurance company. This portfolio is based on the EIOPA (European Insurance and Occupational Pensions Authority) Reference Portfolios, utilizing data published in March 2023 . The reference portfolios are designed to capture the typical asset allocations of European insurers, including life, non-life, and composite (other) insurance companies, which have remained broadly stable over time. The analyses are conducted using four of Ortec Finance’s proprietary climate scenarios, known as the 2025 Ortec Finance Climate Scenarios.

**Figure derived from Ortec Finance’s High Warming Scenario

Contact

Maurits van Joolingen

Managing Director, Climate Scenarios & Sustainability