Political hesitancy threatens to delay Australia’s shift to a low-carbon economy, putting superannuation fund performance at risk. New analysis by Ortec Finance warns that the industry could face significant long-term losses if the net-zero transition is delayed.

The report, which applies Ortec Finance’s proprietary 2025 climate scenarios to the investment portfolios of the 30 largest Australian superannuation funds, shows that on the current high warming trajectory, where global temperatures exceed 3°C by 2100, portfolio returns could decline by up to 38% by 2050.

“Climate change is intrinsically linked to economic fundamentals and is disrupting the vital pillars of economic stability. The effects on GDP growth and inflation are structural, persistent and increasingly visible in economic forecasts”, said Doruk Onal, Climate Risk Specialist at Ortec Finance.

Long-term consequences of short-term political indecision

The findings highlight how political hesitancy, particularly in the lead-up to the federal election in 2028, has the potential to seriously impact the speed of Australia’s transition to net-zero. Even short policy deferrals, of as little as five years, could have a lasting impact on superannuation performance.

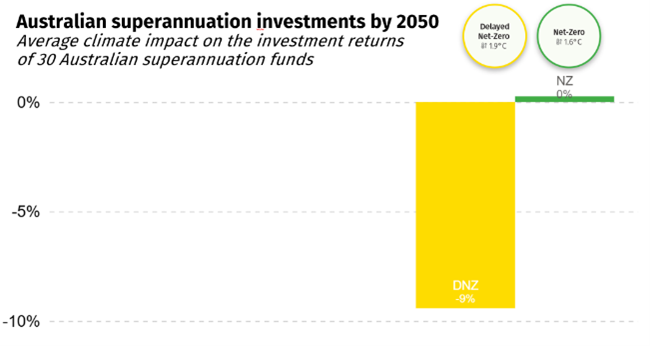

Under such a delayed transition scenario, the average Australian superannuation fund could see around 9% decline in investment returns by 2050, whereas an orderly transition helps superannuation funds to exceed current expectations.

Severe cost of not transitioning to a low-carbon economy

The report projects that Australia’s economy is at risk of suffering substantial long-term damage if climate change remains insufficiently addressed. Under a high warming scenario, where no additional climate policies are introduced, Australian GDP is expected to fall 9% below current expectations of the forecast by 2050.

Rising temperatures and intensifying physical risks steadily undermine economic performance, driving weaker productivity and higher inflation.

By contrast, an orderly net-zero transition allows the economy to remain close to its current growth trajectory, supported by measures such as the recycling of carbon tax revenues to stimulate investment and household consumption.

Climate-induced inflation’s emerging threat to price stability

The report reveals the emerging threat of climate-induced inflation.

As physical risks such as heat stress and reduced agricultural productivity intensify, the scenarios show inflation rising above the Reserve Bank of Australia’s targets and altering long-term expectations. In Australia, a high-warming future is projected to add 0.7% to annual inflation by 2050.

With inflation currently at 2.1%, such an increase would significantly erode household purchasing power. For retirees, this means that savings would buy less at the same time as investment returns fall.

By contrast, transition pathways, where there is tangible progress to a low carbon economy, perform far better: by mid-century, losses narrow to 9% in the delayed transition scenario and 5% in the most optimistic and orderly transition.

The impact on superannuation investment returns

The combination of lower nominal returns and higher living costs creates a dual headwind for superannuation funds. By 2028, portfolios are projected to fall by 2% in a high warming scenario, widening to 6% by 2035 and deepening to 38% by 2050.

Traditional diversification must incorporate geographical exposure to climate change

Climate change is systemic, but it does not impact all geographies equally. If superannuation funds are to mitigate climate risk, they must rethink strategic asset allocation to incorporate geographic variation,” said Maurits van Joolingen, Managing Director, Climate Scenarios & Sustainability at Ortec Finance.

Investment decisions that rely solely on traditional metrics risk overlooking the climate risks embedded in regional exposure. Home bias, inherent in domestic superannuation fund investing, creates concentrated climate risk where home markets are disproportionately exposed to physical risks. In Australia, for example, this includes events such as Cyclone Alfred in Queensland, toxic algal blooms in South Australia and widespread catastrophic flooding in New South Wales.

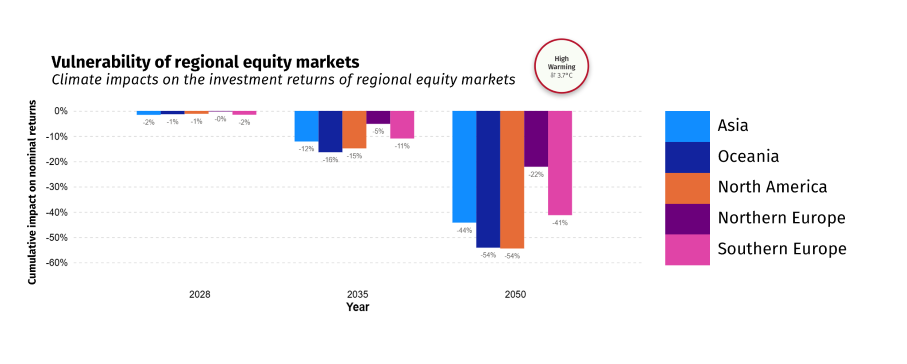

By 2050, equity markets in Australia, along with countries in North America, Asia and southern Europe, are projected to underperform by between 41% and 54% in a high-warming scenario, largely due to exposure to extreme weather events and resource scarcity. Northern Europe, by comparison, shows a smaller 22% decline thanks to cooler conditions and lower physical risk exposure.

Financial markets not pricing climate risk

The report notes that many physical risks that are uninsurable or irreversible, such as climate tipping points, remain underrepresented in asset valuations. This disconnect between current pricing and potential escalating physical risks leaves superannuation portfolios exposed to underestimated downside risks.

“This report clearly shows that the immediate costs of transitioning to a low-carbon economy are significantly outweighed by the long-term physical impacts and escalating costs of continued climate inaction. The future performance of Australian superannuation funds will depend on how decisively the world reduces carbon emissions: an early transition offers steadier growth and inflation, while a high warming future risks severe and lasting economic damage. The industry must plan for both possibilities,” said van Joolingen.

Access the full report - Climate change & Australian superannuation: What’s shaping the 2025 landscape and beyond

To obtain the full analysis, download our report ‘Climate change & Australian superannuation: What’s shaping the 2025 landscape and beyond - Assessing climate risk exposure, current and future challenges with top-down climate scenarios’

Download report Climate Scenarios & Sustainability

Contact

Maurits van Joolingen

Managing Director, Climate Scenarios & Sustainability

Doruk Önal

Climate Risk Consultant