Life insurers face one of the most challenging investment environments in decades. Volatile macroeconomic conditions, persistent inflation pressures, and a widening spectrum of investable assets have created unprecedented complexity in Asset-Liability Management (ALM).

In Asia-Pacific (APAC), where insurance balance sheets are growing rapidly and regulatory frameworks are evolving, many insurers continue to rely on simplistic Strategic Asset Allocation (SAA) models, often built using spreadsheets.

This reliance is understandable. There are often inertia and a natural reluctance to change, particularly when existing workflow processes and downstream models are tightly linked to the current approach. Although spreadsheet-based tools are useful for basic projections, they fall short in today’s reality: highly uncertain markets, increasingly complex products, and the need for optimal capital allocation.

To thrive, insurers must look beyond spreadsheets to adopt more advanced ALM models that can capture non-linear risks, optimise across multiple objectives, and support long-term resilience. Insurers are already accustomed to using sophisticated, model-based approaches on the actuarial valuation side of the business — so it is both logical and timely to bring a similar level of sophistication to asset-focused modelling.

Complexity Demands More Than Spreadsheets

Global insurers are diversifying into private credit, infrastructure, and other alternative asset classes in search of yield and diversification. Surveys — including Ortec Finance’s recent global study — consistently show an upward trend in allocations to private markets, and APAC insurers are no exception. In fact, the survey suggests that over two-thir

ds of APAC insurers plan to increase their private credit allocations by 2026, a significant increase from the previous year.These assets bring unique challenges: illiquidity, irregular cash flows, and default risk. Subtle differences like these can tilt the balance of asset allocation decisions significantly — but they are often missed when relying on simplistic spreadsheet-based tools.

Without advanced modelling, insurers risk misjudging how alternatives perform across different economic cycles, leading to mismatches between assets and liabilities that only surface under stress. This naturally leads to the question of capital optimisation.

Capital Efficiency Is a Competitive Advantage

Insurers’ investment strategy is not only about generating returns, but also about managing regulatory capital efficiently. Jurisdictions across APAC — from Risk Based Capital (RBC) frameworks to International Capital Standards (ICS) — impose capital charges that can materially affect asset allocation choices. Investment-related risks accounts for at least 60% of total risk charges for insurers in Asia-Pacific; for RBC2 Singapore it is even 90%. This further emphasises the need to optimize capital efficiency through investment decision-making. One must also be cognisant of quirks in capital frameworks that provide an attractive return on capital. In Singapore’s RBC2 framework, for instance, investment-grade private credit benefits from favourable treatment: it incurs only the counterparty default risk charge and does not attract separate credit spread or interest rate mismatch risk charges, unlike equivalent public bonds.

Sophisticated ALM models allow insurers to integrate these capital considerations directly into portfolio optimisation. This enables them to identify assets that deliver attractive returns while consuming less capital, thereby strengthening solvency ratios and freeing capacity to reinvest in new products, distribute dividends, or pursue strategic growth opportunities. Capital-efficient portfolios are also less likely to trigger extreme volatility in solvency ratios during stress scenarios, enhancing balance sheet stability.

Stochastic models elevate this further by stress-testing capital ratios under a wide range of market conditions, giving management a clear view of trade-offs and ensuring that balance sheet resilience is never compromised in the pursuit of yield.

Diverging Views Require Flexible Scenario Testing

Today’s markets are shaped by uncertainty — and uncertainty breeds variance. Asset managers and economists disagree on whether inflation is transitory or persistent, whether interest rates will remain higher for longer, and how private markets will perform relative to their public counterparts. For life insurers, these debates are not academic: they directly influence return expectations, solvency outcomes, and the sustainability of guarantees embedded in products.

Advanced ALM models give insurers the ability to test these competing worldviews systematically. By consistently imposing views on asset classes across multiple time horizons, insurers can see how their balance sheets evolve under each perspective. This provides management with a structured way to compare strategies and avoid over-reliance on a single economic narrative.

Crucially, advanced models also enable narrative-driven scenario analysis. Rather than relying purely on historical data, insurers can design bespoke scenarios that reflect plausible but extreme futures: a prolonged trade war disrupting global supply chains, a stagflationary environment eroding both growth and asset values, or the effects of climate change. This ability to test and compare diverging views is more than just risk management. It is a strategic decision-making tool that allows insurers to navigate uncertainty with confidence and position themselves competitively in an increasingly complex and contested investment landscape.

From Point Estimates to Probabilistic Planning

A core weakness of simplistic SAA approaches is that they are often deterministic — projecting a single path of asset returns and liability growth. While this provides a neat narrative, it creates the illusion of precision and fails to capture the uncertainty insurers actually face.

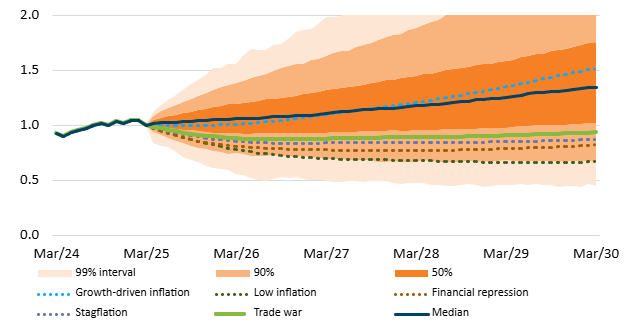

Stochastic modelling offers a critical upgrade by simulating thousands of possible economic paths, giving a full distribution of potential outcomes. It highlights not only expected returns but also downside risks, solvency pressures, and liquidity shortfalls. This provides management with a far richer understanding of how their balance sheet might behave under real-world uncertainty.

This comparison illustrates the difference: deterministic models produce a single “best guess” line, while stochastic simulations generate a fan of possible outcomes — exposing volatility and tail risks that truly matter for solvency management within the context of SAA.

Yet even traditional stochastic approaches and optimization techniques can struggle to capture the non-linear interactions of today’s markets, especially as insurers increase allocations to private assets and design more complex products. This industry-wide problem is best addressed with Scenario-Based Machine Learning (SBML), pioneered by Ortec Finance.

Scenario-Based Machine Learning: The Next Frontier

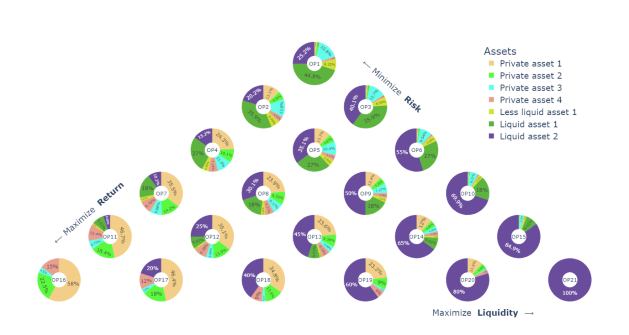

Globally, it is becoming increasingly common for insurers to optimise their SAAs using non-linear objectives such as:

- Present value of distributable earnings (PVDE)

- Liquidity demand / shortfall probability

- Risk adjusted return on capital (RAROC)

This trend is expected to accelerate in APAC as competition intensifies.

By combining robust scenario generation with Machine Learning algorithms, SBML can uncover hidden patterns, adapt quickly to new information, and identify optimal strategies across a much broader solution space with a superior risk-return profile. It can also solve in higher dimensional spaces, producing an efficient plane of portfolios that balance multiple objectives simultaneously.

For APAC insurers, SBML provides both a practical incentive and a strategic pathway to move beyond point-estimate planning into probabilistic, adaptive decision-making — a capability that is becoming essential in an environment of persistent volatility, regulatory change, and evolving product innovation.

Products Are Evolving, and So Must ALM

The liabilities side of the balance sheet is changing rapidly. Indexed Universal Life (IUL), in particular, is reshaping how insurers think about both investment strategy and policyholder engagement.

At a design level, IUL creates a dual challenge:

- The fixed account requires stable fixed income to deliver guaranteed minimums.

- The indexed account credits returns linked to equity indices, often hedged through options or structured products.

Understanding the distribution of index returns influencing future crediting rates, disintermediation risks across alternative macroeconomic regimes, the stability of option costs and participation rates are essential for effective risk management – ALM models powered by Real World economic scenarios make it possible to manage these dynamics holistically. Traditionally, many insurers rely on risk-neutral scenarios for valuation and TVOG purposes. While suitable for pricing guarantees, they are not sufficient for long-term asset allocation or product management.

Without such modelling, insurers risk underestimating the embedded risks of new product designs, mispricing guarantees, or eroding solvency margins over time. With it, they gain the confidence to innovate and expand product offerings, knowing that investment and liability risks are fully integrated into their decision-making.

Asset-Intensive Reinsurance: Putting Assets Under the Spotlight

One of the most significant global trends in life insurance is the rise of asset-intensive reinsurance (AIR). These transactions — where reinsurers assume not only the liabilities of life or annuity blocks but also the asset and reinvestment risks backing them — have become the norm in North America and Europe, and APAC markets are now rapidly following suit.

In markets such as Hong Kong and Singapore, AIR offers clear benefits: capital relief under HKRBC and RBC2, stronger solvency ratios, and balance sheet capacity to pursue growth. Regulators are actively refining their frameworks to attract this activity, positioning their jurisdictions as regional hubs competing with established global centres.

Traditionally, reinsurers have built deep expertise in valuing and managing liabilities with precision. In AIR, however, the competitive edge increasingly comes from demonstrating the same level of sophistication on the asset side — showing how portfolios will perform across a wide range of future market conditions.

Managing these risks requires more than static assumptions. Robust ALM frameworks powered by stochastic economic scenarios enable reinsurers to:

- Integrate the balance sheet: capture how credit spreads, reinvestment yields, inflation shocks, and liability dynamics interact.

- Optimise for capital efficiency: simulate portfolios across long-duration bonds, private credit, infrastructure debt, and alternatives to achieve yield without excessive capital strain.

- Demonstrate regulatory credibility: model long-term risks and capital impacts consistently, meeting rising expectations around transparency and stress testing.

From Silos to Synergy: The Total Portfolio Approach

Traditional Strategic Asset Allocation (SAA) frameworks often view portfolios through rigid asset class buckets. While useful for governance and reporting, this siloed approach can obscure the true drivers of portfolio risk and return.

The Total Portfolio Approach (TPA) offers a more holistic lens. Instead of focusing on static weights, TPA evaluates each investment by its marginal contribution to the fund’s overall objectives — risk, return, liquidity, and solvency. Within a TPA framework, risk budgets are set not only at the total fund level but also across exposure buckets — often expressed as factor exposures such as equity beta, credit, duration, or inflation sensitivity. This approach avoids the rigidity of asset class silos and instead allocates risk along the dimensions that truly matter for balance sheet outcomes. It enhances transparency, gives CIOs the flexibility to shift dynamically across asset classes, and ensures that both public and private markets are managed against the same underlying drivers of risk.

Crucially, the same advanced ALM models that support insurers’ traditional SAA processes are also well set up to facilitate a TPA mindset. Stochastic modelling can:

- Evaluate exposures consistently across both traditional and alternative assets.

- Simulate outcomes at the SAA level (capital charges, solvency impact) and at the TPA level (marginal contribution to objectives).

- Allow management to flex seamlessly between regulatory-driven SAA frameworks and forward-looking, TPA-style decision-making.

For insurers, this dual capability is a significant advantage. It enables them to continue meeting regulatory requirements under existing SAA processes, while gradually embedding TPA practices that position the organisation for more agile, transparent, and resilient long-term decision-making.

Conclusion

The prevailing macroeconomic landscape and significant competition in APAC has created a far more complex investment universe for life insurers. Those who continue to rely on spreadsheets risk falling behind, with investment choices unsupported by adequate modelling precision. The consequences can be serious: diminishing solvency, inefficient use of capital, and missed opportunities in product innovation.

Sophisticated ALM frameworks — from traditional stochastic simulations to emerging optimization techniques like Scenario-Based Machine Learning (SBML) — give insurers the ability to capture complexity, optimise capital, and align investment strategy with evolving liabilities.

For APAC insurers, the call to action is clear: reassess your ALM processes today. Inertia may feel comfortable, but the firms that embrace advanced modelling now will secure an edge — stronger solvency, greater flexibility to write business, and the confidence to innovate in an uncertain world.

Contact