Inflation-protected portfolios typically provide a combination of diversification benefits and return improvement. For example, by diversifying to “real assets,” like commodities, direct real estate or infrastructure, the eroding effects of inflation can be cushioned, as each asset responds to inflation at a different speed. Besides protecting the portfolio against inflationary volatility in this way, resilience can also be created by increasing expected returns. Investing in private assets can be a capital-efficient way to do this, insurers however, must also take into account the additional liquidity risk.

Private assets

The domain of private assets is diverse and includes real estate, hedge funds, private debt, infrastructure and private equity, with the latter being very popular among insurers. This is despite its punitive capital treatment, as seen under Solvency-II (Type 2 shock: 49%) or the US RBC framework (30%), although, this level of penalty does seem to be more of an exception than a rule for the asset class. Generally, private assets are treated more leniently, especially for insurers with longer-term liabilities, largely offsetting the illiquid nature of private assets.

For insurers with shorter-term liabilities, investing in private assets can also be attractive in certain conditions, in particular “tailoring” of private investments is a trend well received by the insurance industry. By having this flexibility to customize relevant investment features, such as risk and return or legal structure, tailored private assets can become highly effective tools, from both a capital standpoint, and in their effectiveness in dampening and exceeding inflation. Evidently this golden combination has raised the appetite for private assets, particularly in the current inflationary market environment.

Tailored private assets

Among the more innovative applications of private assets are “insured credit,” “syndicated loan (carve-outs)” and fund pooling. Offered as private, fully insurer-adaptable and capital efficient alternative asset classes, they are proving popular ways to generate inflation-resistant returns, For example, as an alternative to a direct investment in private equity, investors could hold indirect positions via “feeder funds,” i.e., a customized debt structure, which under US RBC receives significant lower capital treatment, when compared to a direct position.

Given the potential of so many newly created forms of private assets, especially for use as a combatant against inflation, it is not surprising that insurers expect to increase their exposure to private assets. In order to do this appropriately the question for each insurer then becomes, is it worth the extra risk? And how should risk be assessed?

Risk and return assumptions

At Ortec Finance we model the expected returns and risk of a wide range of asset classes, including private assets based on Economic Scenario Generator models . Any tailored asset requires individual customization in the form of, for example, additional Capital Market Assumptions on top of the assumptions for the “generic” asset class, e.g., added consistently as an “expert view”.

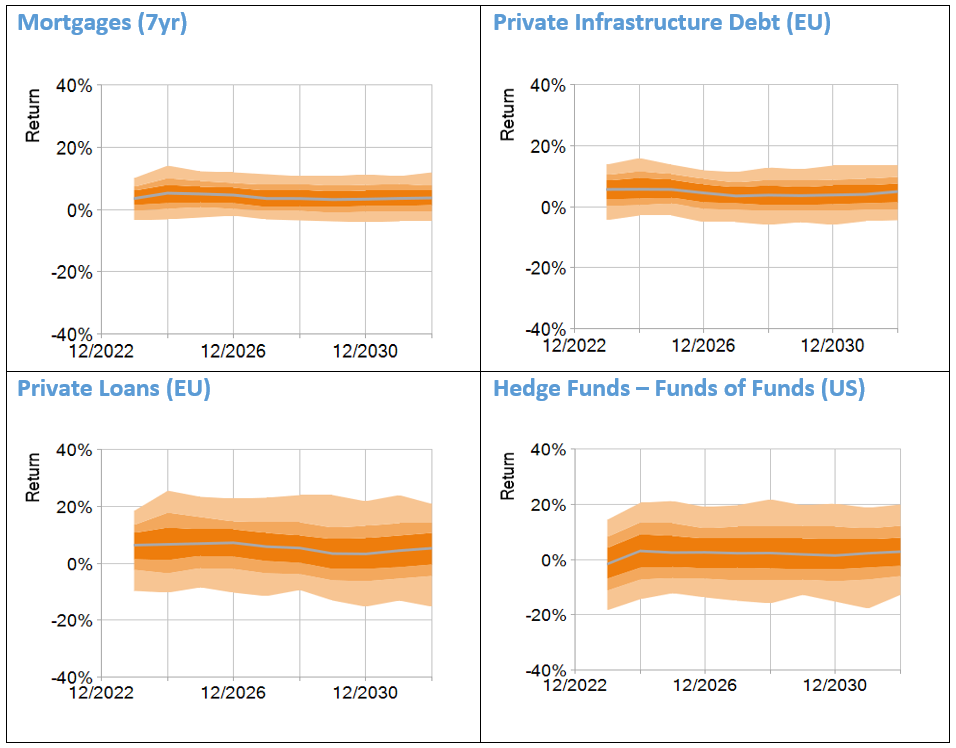

By way of example, the following analysis focuses on the characteristics of 4 asset types: Mortgages (7 year), Private Infrastructure Debt, Private Loans (EU) and Hedge Funds (US), all euro-hedged (Box 1). What stands out is that all have attractive baseline yields but with different expected volatility. Insurers interested in one of the asset types could incorporate these in their balance sheet projections, for example, to assess risk.

Box 1: Scenario generated returns (EUR hedged)

Source: return projections based on Ortec Finance’s Economic Scenario Generator – 02/2023

How to assess risk

Private assets’ inherent lack of liquidity is what makes them – on the one hand – so attractive, as the offered liquidity spread provides the foundation for additional return. But on the flip side, this can be their Achilles heel, especially during times of market stress. Insurers need adequate liquidity to avoid forced selling in such situations.

Some insurers are naturally protected, at least partly due to the nature and duration of their liabilities and cash flow matching. To others, the risk is mitigated by carrying a liquidity buffer, like a High-Quality Liquid Asset (“HQLA”) portfolio. However, both the contents of this buffer (which assets to put in), as well as of its size, is something not easily decided upon. As pension funds learned from the recent GILT crisis, assets that are considered liquid today can become illiquid tomorrow.

Insurers that seek to increase their allocations to private assets to combat inflation, should therefore perform a holistic assessment of their liquidity position, including times of market stress. Stochastic scenario simulation models are a powerful tool to perform such complex analysis.

The key is to assess the impact of unfavorable scenarios from a full balance sheet perspective. To each insurer this impact can be surprisingly different. Additionally, insurers taking a tailored approach to private assets should also ensure their ALM model can be customized accordingly, as this might be the only way to stay on top of risk while realizing the desired inflation protection benefits.

Contact