Portfolio optimization allows investors to make optimal risk-return trade-offs and plays a crucial role in their investment decision process. Unfortunately, optimal portfolios are sensitive to changing input parameters, i.e. they are not very robust. Traditional robust optimization approaches aim for an optimal and robust portfolio which, ideally, is the final investment decision. In practice, however, portfolio optimization supports the investor’s investment decision process but seldom replaces it.

Near optimal portfolios

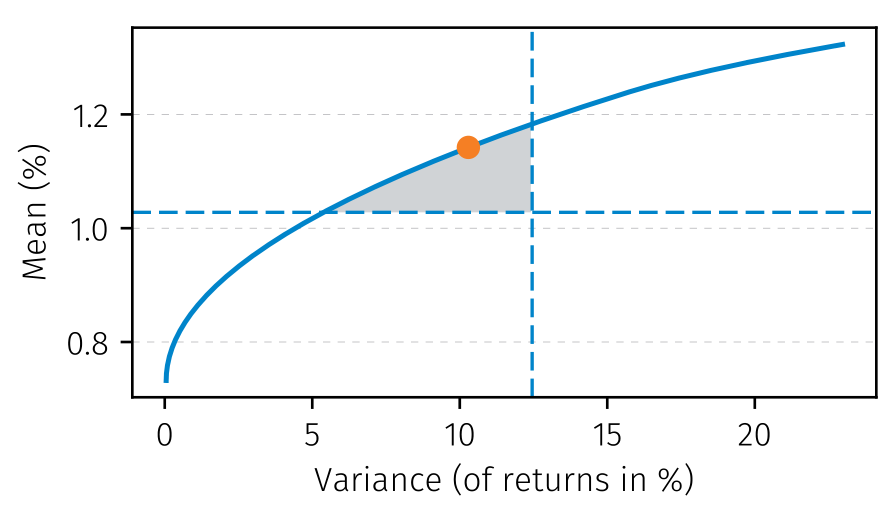

At Ortec Finance, we developed an approach that both solves the robustness problem and aims to support rather than replace the investment decision process. The method determines a region with near-optimal portfolios, i.e., all portfolios in the gray region. In light of the robustness problem, all near-optimal portfolio can be considered good allocation decisions. Then, as is already common practice, an investor can bring in an expert opinion or additional information to select a preferred near-optimal portfolio.

We can show that the region of near-optimal portfolios is significantly more robust than the optimal portfolio itself. Intuitively, this is understandable: with slightly different input parameters, the near-optimal region slightly changes in shape, but most near-optimal portfolios remain near-optimal. For example, the old optimum becomes near-optimal and one of the near-optimal portfolios becomes optimal. For the investor, his allocation becomes more robust, because no revision is needed when it remains near-optimal.

Making better investment decisions

Moreover, the method focusses on supporting rather than replacing the investment decision process. Despite many efforts to make models and optimization problems as realistic as possible by for example incorporating transaction costs, expert opinion and liquidity, a model remains a simplification of reality. The near optimal region allows the investor to choose from many portfolios rather than one portfolio. In the near future, Ortec Finance aims to experiment with and test the added value of this approach. We believe that this method will give investors more insight and that it enables them to make better investment decisions.

Publication in VBA Journaal

VBA Journaal published a paper written by Martin van de Schans about the role of portfolio optimization. Portfolio optimization is the current academic standard for determining an investor’s optimal portfolio. By incorporating future return information and the investor’s goal into the optimization problem, it aims to determine the investor’s optimal investment decision. In the paper is shown how near-optimal portfolios can be used in a new methodology for portfolio construction.

More information?

More information can be found in our working paper. Do you want to know more about portfolio optimization? Feel free to contact Loranne van Lieshout, Marnix Engels or Martin van der Schans.

Contact