Our Economic Scenario Generator integrates short and long investment horizons consistently across all asset classes and economies. The methodology applied – a frequency domain approach combined with dynamic factor models – aims to capture complex realities as best as possible.

Periodic back-testing research

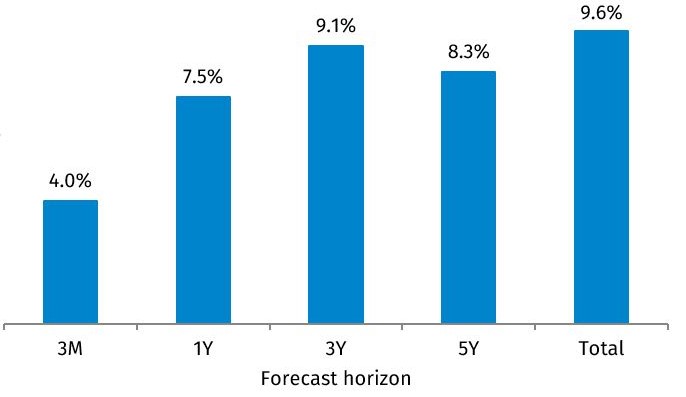

How well does our methodology behave in back-tests? After all, a scenario model is as strong as its ability to project future events in a realistic way.Our back-testing results indicate a 10% outperformance compared to competing approaches and models. We see the strongest forecasting performance on a medium-term 3-year horizon.

Besides measuring how well our models perform in terms of expectations, we also back-test the quality of our scenarios for different confidence intervals.