In his popular book “A Brief History of Time”, Stephan Hawking introduces the complex world of (astro)physics to a larger audience. One of the phenomena it describes are black holes, massive stars that collapse under their own gravity and attract everything in their vicinity towards their center. The book also describes the Event Horizon. This imaginary boundary close to a black hole is the point where gravity becomes so massive that even light cannot escape its grip, giving rise to the name ‘black hole’.

This point of no return is an interesting concept that has been widely used in many other contexts. In this article I would like apply it to the balance sheets of pension funds. The health of pension funds is often described by the funded ratio, which is the ratio of assets compared to the value of the liabilities. A funded ratio of 80% for instance implies that the value of the assets is 80% of the size of the liabilities, a reality faced by many funds globally. The funded ratio of pension funds differs dramatically across the world, with well-funded schemes reporting ratios far above 100%, where other funds face a much more dire situation with a funded ratio even below 30% (1).

The dangers of low-funded ratios

Other than being a measure of health, a funded ratio can also say something about the ability to recover. For instance, imagine a fund with a funded ratio of 50%. Although it only has 50% of assets to cover every monthly benefit payment, it pays out the full benefits every month, as all funds do. By doing so it effectively decreases the funded ratio even further, given that the other 50% of benefits are paid by the remaining members. This in turn makes recovering to a funded ratio of 100% even harder. An outperformance of the investments against the liabilities could help, but a low-funded ratio makes such a recovery much more difficult. In our example it would require the assets to make the same dollar return as the liabilities, although they are only half the size.These two effects make it especially hard to recover from low-funded ratio without the help of additional contributions from the corporate or government that is backing the fund. One could ask the question at which funded ratio the aforementioned effects become so strong that recovery is no longer a certainty. In other words: what is the event horizon, or the point of no return?

A quantitative approach

In a recent paper (2) from the Rockefeller Institute at the State University of New York, it is argued that a funded ratio lower than 40% could be considered a good indicator of a deeply troubled US pension fund. The Center for Retirement Research found that only four funds out of 150 in the US had a funded ratio lower than 40%. These four funds were all broadly recognized to be deeply troubled. In a recent project however, Ortec Finance took a more quantitative approach to determine whether a funded ratio of 40% could indeed be considered a point of no return, or whether this point could potentially be higher. Please note that, as in in the Rockefeller paper, we only focus on the asset side of the balance sheet and do not take into account potential policy or recovery measures resulting in lower liabilities.

Ortec Finance took a more quantitative approach to determine whether a funded ratio of 40% could indeed be considered a point of no return.

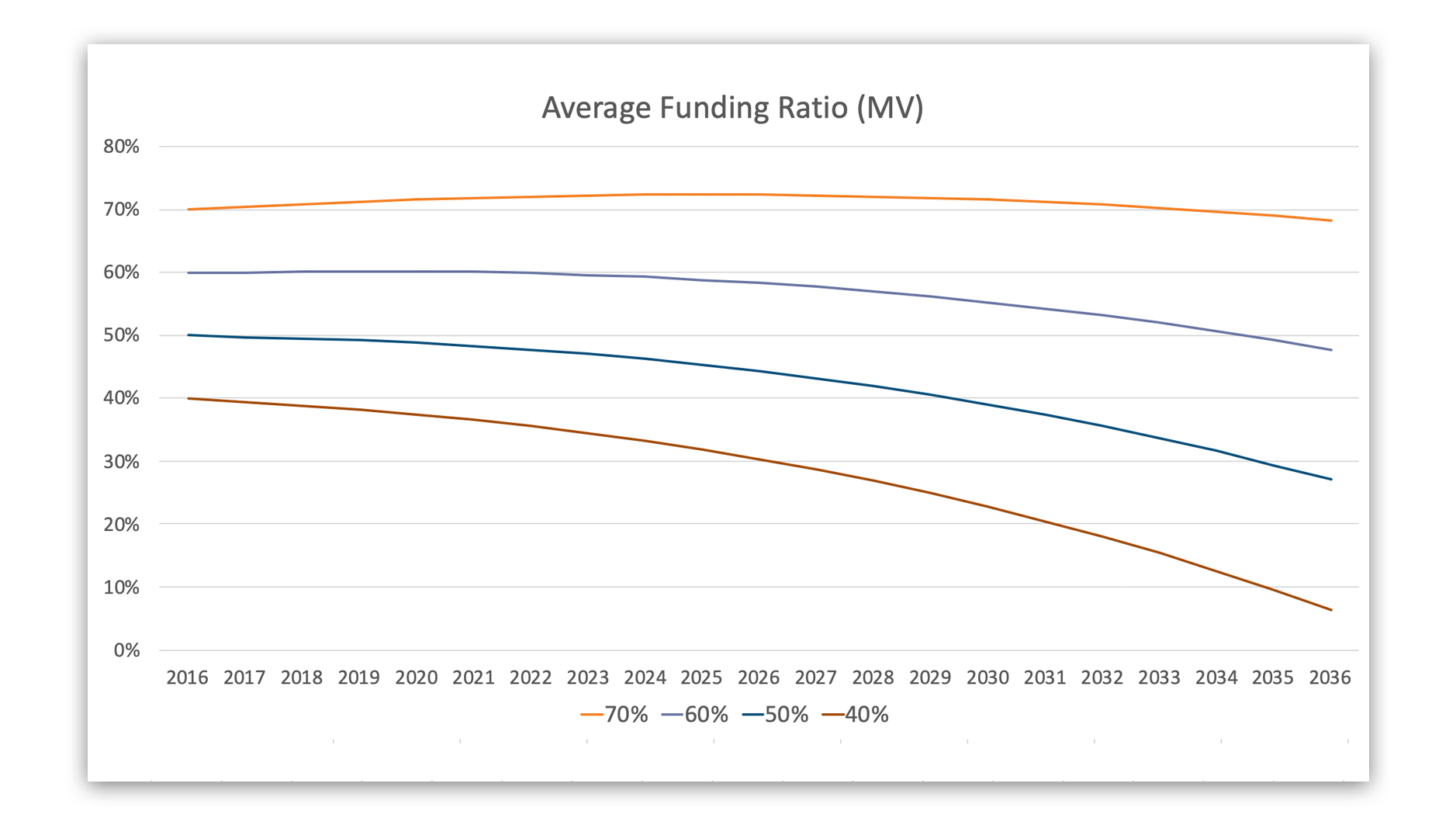

To determine the point of no return for pension plans we take two approaches. First we model a pension plan’s balance sheet and project it deterministically 20 years forward, based on a number of forward-looking economic assumptions regarding the development of the interest rate, inflation and return on assets. We use a return on assets and discount rate of 7.25%, frequently used by public schemes across the US, and allow for a contribution level that is slightly above the cost of new accrual. The projection is based on a pension scheme with an average maturity. The analysis is performed by adjusting the initial funded ratio and assessing the development of the funded ratio:

The point of no return

The graph above shows that a funded ratio of 40% can indeed be considered a clear sign that the plan is deeply troubled. Even if a return on assets is able to keep up with the discount rate the plan will see a rapid decline in funded ratio, which can only be stopped by very significant recovery contributions. We can also see that even a funded ratio of 60% leads to a decline in funded ratio, which will only accelerate over longer horizons. In that sense, a funded ratio of 60% can already been seen as a point of no return.

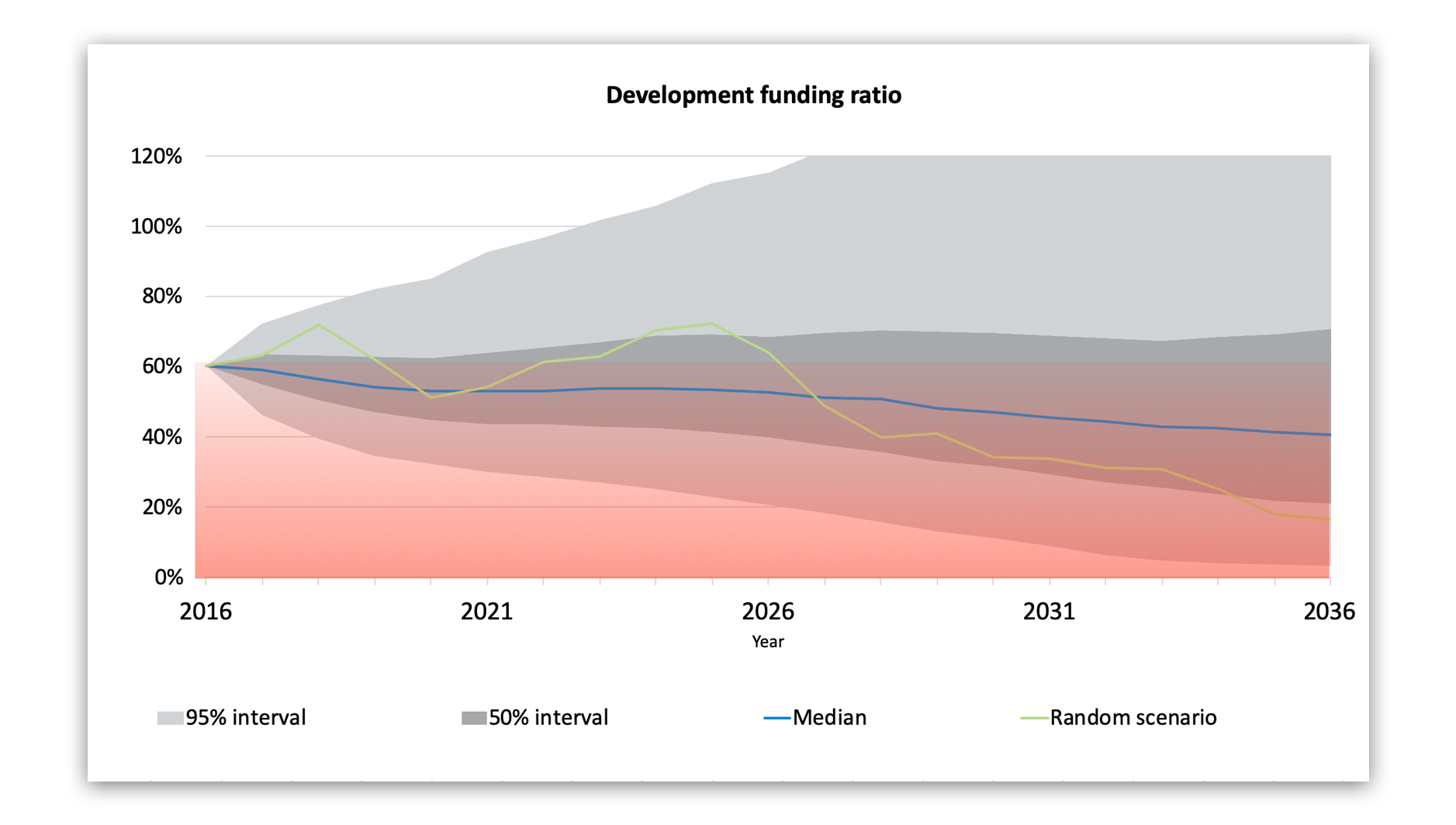

The economic environment is of course much more dynamic than the smooth deterministic returns used in the example above. In order to get insight in the development of the funded ratio, actuaries and risk managers often fall back on stochastic analysis. In such analyses, a large number of realistic economic scenarios are created and then applied to the same balance sheet model as used above. This approach results in a large number of possible developments of the funded ratio under realistic circumstances, and can be used to further examine the behavior of the funded ratio. The analysis below shows the impact on the funded ratio for 2,000 forward-looking economic scenarios.

An overwhelming 70% of the scenarios end up in a situation which is worse than the starting point.

Event horizon at 60%

The graph shows an analysis of a semi-mature fund which is open for accrual, and has an initial funded ratio of 60%. The graph shows the development of the funded ratio through time across 2,000 different economic scenarios, divided in two confidence intervals of 50% and 95%. To assess whether the event horizon is indeed close to 60% we highlighted the median over the scenarios in blue, which shows a steady decline to a level around 40%. Moreover, an overwhelming 70% of the scenarios end up in a situation which is worse than the starting point, underlining our conclusion that pension plans with funded ratios below 60% can be considered deeply troubled.

If we use this level of 60%, rather than the 40% that the Rockefeller Institute used, and apply this to the database from the Center of Retirement Research, we find that the number of deeply troubled pension plans increases from just four to 36.

Identifying deeply troubled plans

The point of no return can be used to identify plans that are deeply troubled but also has other applications. For instance, we would suggest that plans take this point of no return explicitly into account when they define their risk appetite as a basis for their investment strategy. Once a plan falls below this level, the ability to recover decreases dramatically and is unlikely to succeed without significant contribution. The sheer size of the liabilities make it very hard for plans and their sponsors to adjust course once they hit this point, and it requires careful planning to avoid this black hole. It would also make sense for funds to draw up plans beforehand, so that they know what to do once they reach such levels, such as requiring additional contributions to avoid a deeply troubled plan being drawn further into the black hole. Finally, the point of no return depends on a number of variables and will differ across plans; hence we recommend performing such an analysis as part of the next strategic review.

(1) Please note the exact calculation method of the Funding Ratio and e.g. applied discount rate are not the same in different countries

(2) Investment Return Volatility and the University of California Retirement Plan, Donald J. Boyd and Yimeng Yin, The Rockefeller Institute of Government State University of New York