Innovation in goal-based planning

In our previous blog, we listed a number of innovations that Ortec Finance has worked on in the past year(s). The first and maybe the biggest one is the concept of Goal Monitoring. While already available for a while, its importance and relevance has been highlighted by the outbreak of the global pandemic, leading to significant market downturns and increasing uncertainty on the markets.Why would you advise a client to take on more risk than actually necessary? This is a question we have asked ourselves numerous times in the past couple of years. Even though the question may seem rhetorical, it is not common practice to check whether the risk level of a client’s portfolio actually fits with risk necessary to achieve the goal. Most portfolio decisions are still mainly driven by the outcome of a generic risk questionnaire. The connection between this decision, the client’s financial situation, the goal and the remaining horizon is often absent.

Advisors can add more value to the client

As time progresses, the value of a portfolio will fluctuate based on the performance on the markets and client deposits and withdrawals. Over time, there may be opportunities to reduce the risk of the portfolio due to better-than-expected results. As markets have shown earlier this year following the outbreak of the COVID-19 pandemic, timely mitigating the downside of a portfolio may be beneficial to both client and advisor. In contrast, during the investment horizon there may also be need for adjustments to the plan, when performance disappoints. Pro-active suggestions and timely course corrections clearly prove the added value of the advisor to the client, so why isn’t this common practice yet?Need for realistic portfolio projections

In order to monitor client goals pro-actively, advisors need to have insights into realistic and up-to-date projections of the client’s portfolio. Realistic projections require a more sophisticated approach than simply looking at past performance of the portfolio. In our previous white paper, we explain that in order to provide quality portfolio projections, using the current market practice with simple ‘Monte Carlo’ simulations is not sufficient to get insights into the probability of success of client goals. Providing up-to-date and realistic insights as to whether a portfolio is likely to reach its objective is not easy, but a solution exists. With Ortec Finance’s monthly updated economic outlook and the operational capacity to evaluate hundreds of thousands of portfolios overnight, wealth management firms can start bringing this additional value to their advisors, portfolio managers and clients.Proving the added value of goal monitoring

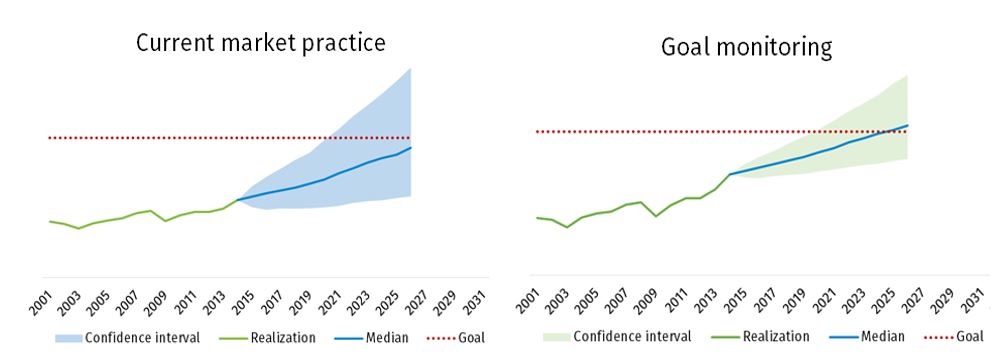

Theoretically, the idea of pro-actively reducing the amount of risk in the portfolio after better-than-expected results and/or a shorter investment horizon sounds appealing. The question is, from a research perspective, whether this idea holds in practice. We have back-tested this methodology based on our back-dated economic outlook until the year 2000. We compare a static portfolio decision with a dynamic approach, which re-evaluates the portfolio decision every year based on the updated projection of the portfolio, given the actual realization on the markets. The decision rule is based on the principle that the advisor adjusts the risk of the portfolio to the minimum amount possible, given the risk appetite and ambition of the goal. We find that for multiple use cases, historical windows, goal ambition and initial risk levels our dynamic strategy leads to better outcomes for the client. In every case, the dynamic strategy either leads to a higher value portfolio at the end of the investment horizon or achieves the goal with less exposure to market downturns. Read our latest white paper for more background information.

Figure 1: Taken from our white paper, an illustration of how proof the added value of pro-active goal monitoring. On the left, the portfolio decision is static, for the ‘Goal monitoring’ strategy, each year, the portfolio may be adjusted based on the updated projections, as illustrated by the green confidence interval.

The technology is there, why wait?

Recent turbulence in the financial markets and the current uncertainty around the global economy highlight the necessity for frequently updated plans and goal-based strategies. Common market practice to provide a static plan to help clients reach their financial objectives, based on past performance only, is outdated. During challenging times, the need for changing the way we operate becomes very clear. The technology to help advisors improve the investment decision making of their clients in a cost-effective and efficient way is available, so why wait?Most of these innovations are already possible using our current solution and technology. In many cases, it is the way that the technology is deployed that makes the difference. Click here if you would like to learn more about our current offering for goal-based planning and monitoring.

Contact