Access to data is becoming ever more important. That is why asset owners and asset managers are now using data warehouses for storing holdings and market data, among others. This allows them quick and easy access, and ensures that the same data is used across the entire organization, enhancing consistency. Yet there are still questions about which data should be stored, and discussions about how to choose the right data for specific analyses can be difficult. PEARL can provide a helping hand.

Building a Performance Book of Records

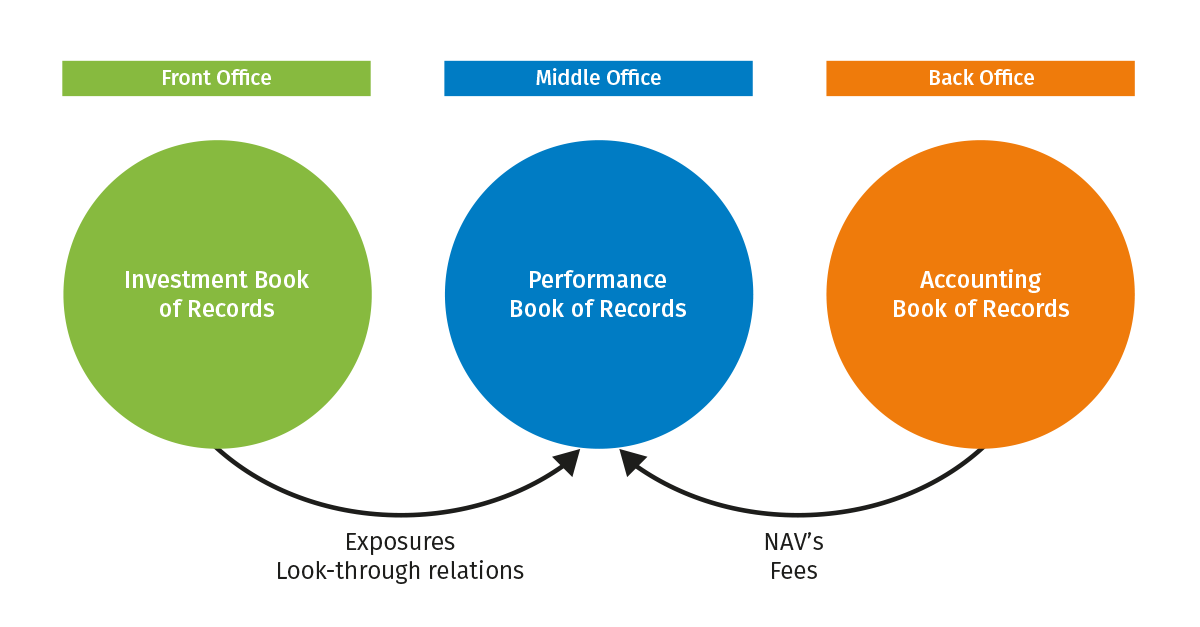

The Investment Book of Records (IBOR) and Accounting Book of Records (ABOR) serves the front and back offices respectively. Both have been adopted on a large scale. One of the dominant discussions has been on which of these sources the performance evaluation process has to run. The ABOR gives access to stable and accurate data that is reconciled on a frequent basis, typically what a performance team is looking for. On the other hand, due to the many checks and balances data availability is often lagging behind and often does not fully reflect the actual investment process anymore.

This is where the IBOR comes into play, which does reflect the actual investment process and gives an almost instant reflection of the current positions. IBOR however lacks the robustness of ABOR data.

Often both are stored and each is used for a different part of the performance evaluation process. The ABOR is used for the official return calculations where the IBOR is used for the in-depth performance attribution analyses.

We think the middle office should strive to combine the best of both worlds and take a step further to create a Performance Book of Records (PBOR). The PBOR connects the official ABOR and up-to-date IBOR and enhances those with measures critical for performance measurement like cash-backing for derivatives and look-through relations. This gives the middle office the flexibility to select the best source for any type of analysis and keep control of the performance process as a whole. For larger asset management firms and asset owners in particular, who have to deal with various asset classes and portfolio managers, only reverting to the ABOR or IBOR won’t cut it as the requirements will vary in terms of frequency and timing for various portfolios.

So, we see a clear case for a Performance Book of Records that the middle office manages. It allows for better control of:

- The quality of inputs (e.g. most recent or audited)

- The analysis itself

- Efficient distribution or reports across the organization.

PEARL creates your PBOR

Creation of a PBOR can be done relatively straightforward. PEARL, our Performance Measurement, Attribution, Ex-Post Risk and GIPS composites platform includes the functionality to create a PBOR off-the-shelf. Although not that many people are fully aware of this capability of PEARL, it is yet in use by many asset owners and asset managers across the globe.

If you want to find out more about how we support this in our solution, please have a look at our product page PEARL or contact us for a demo.

Contact

Bas Leerink

Head of Global Implementations Investment Performance

Oliver Henriquez

Sales Director, EMEA