The new UK regulation Consumer Duty is trending and deadlines are fast approaching! Are you ready? Financial institutions should have completed all necessary reviews to meet the outcome rules for their existing open products and services by April 30. And don't forget, July 31 is the deadline for new and existing products or services open to sale or renewal!

With the recent announcement of £5.3m in new funding assigned to the regulation, the FCA will be undertaking sector-specific supervisory work. This highlights the importance of embedding the Consumer Duty in your organization and implementing best practices with a strong consumer focus, not just focusing on compliance.

At Ortec Finance, we have regular talks with our clients and partners about the new Consumer Duty in which the focus lies on:

- Putting consumers at the heart of their business and focus on delivering good outcomes for them: providing products and services that are designed to meet customers’ needs, providing fair value, helping customers achieve their financial objectives and which do not cause them damages.

- Communicating and engaging with customers to ensure they can make effective, timely and properly informed decisions about financial products and services and can take responsibility for their actions and decisions.

- Monitoring and regular reviewing of outcomes that their customers are experiencing in practice and take action to address any risks to good customer outcomes.

Impact to the Industry

The implementation of Consumer Duty has a significant impact on banks, wealth managers and financial advisers, as they will need to review their business models, products, and services. Once the focus is on the client and good advice is provided, together with transparent investment decision making support; clients will be served in a good way!

Ortec Finance’s OPAL solution helps advisers and clients with their investment decision making process. With a goals-based approach, insight in risk and return on the short and long term, the clients’ expectations can be managed.

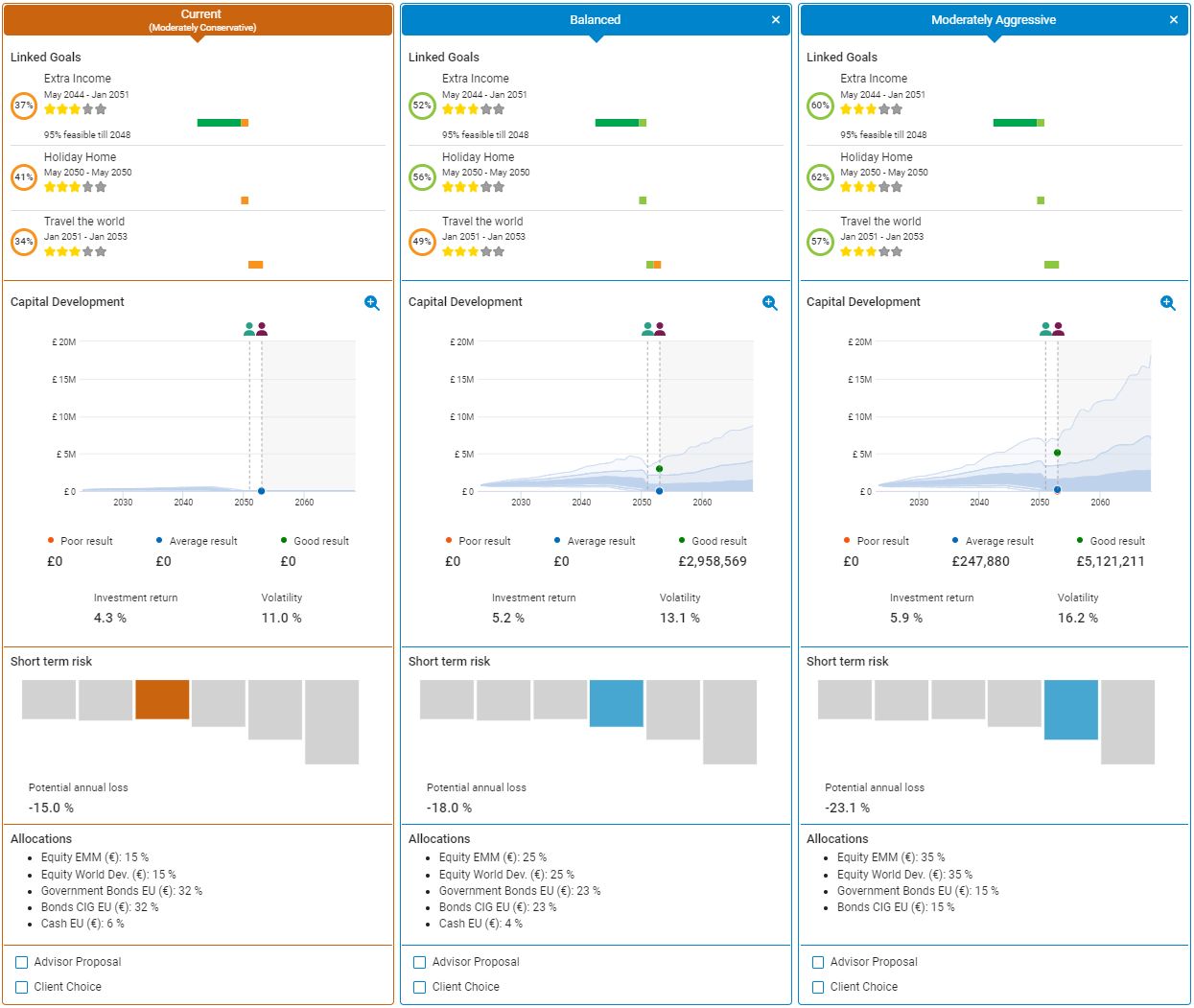

The realistic wealth projections provided by Ortec Finance enable the adviser and client to analyze the impact of different investments decisions on clients’ goals and decide if the risks taken are acceptable.

Realistic economic scenarios which are updated regularly, lead to improved insights in the trade-off between risk and return and subsequently to better investment decisions. Our OPAL front-end adviser solutions, built upon our OPAL API, make it possible to compare several risk profiles, tailored to the strategic asset allocations of the bank/wealth manager.

In doing so, clients and advisers are enabled to talk about their financial goals in relation to their investments.

Fair Value

Under Consumer Duty, the concept of ‘Fair value’ is used. This is the amount a consumer pays for a product or service, which must be “reasonable” when compared to the benefits the product or service rendered.

Fair value is about more than just price. It translates to suitable features that foresee harm and prevents frustrating the customer in using the product or service for the duration of the product. Within investment decision making, this implies that banks and wealth managers not only have to deliver on value, but also monitor how the decisions made today and ongoing market conditions impact the future goals of their clients.

Ortec Finance’s OPAL UI and API software enables banks and wealth managers to manage this process and continuously monitor and evaluate their clients’ goals, based upon the goals and underlying assets that they have set together with clients.

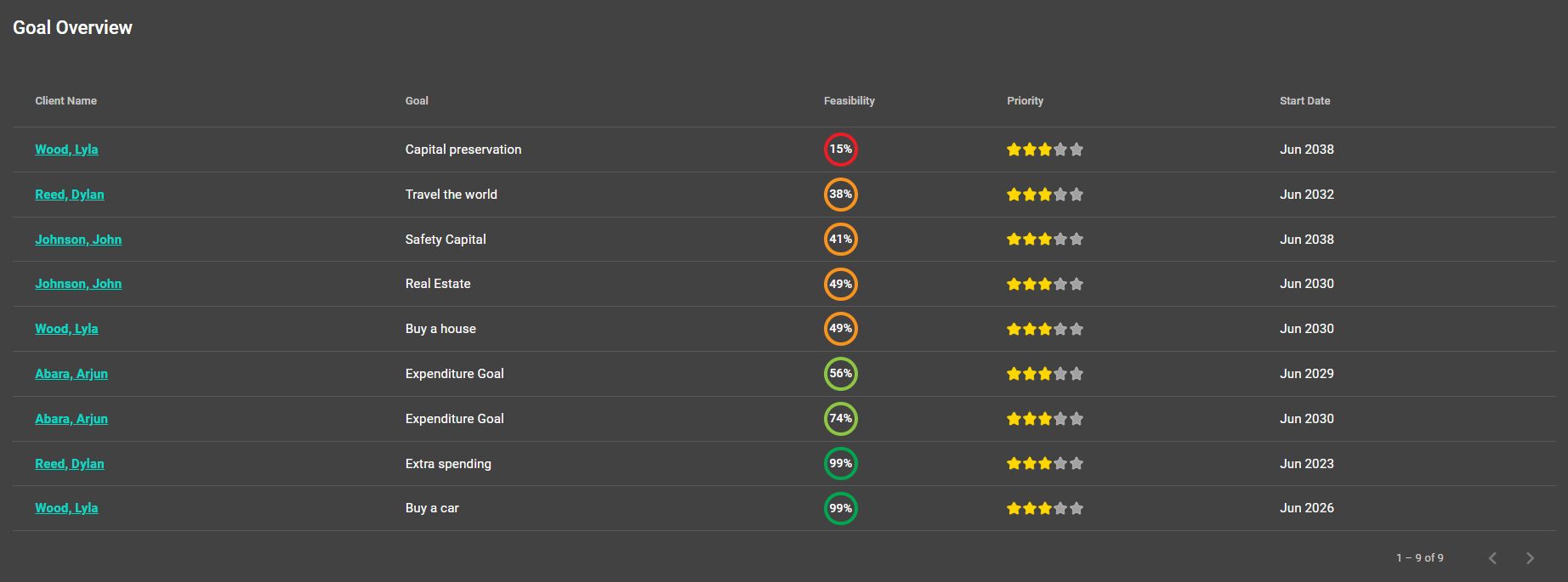

Managing your client base

Manage your client base pro-actively and alert to when your clients are off-track to achieving their goals, with the ability to filter your clients on goal priority, time horizon, goal feasibility and the current risk profile of the portfolio in relation to the risk attitude of your client. Ortec Finance’s OPAL solution may even provide automated solutions to get back on track again for those clients which are off-track to their goals.

OPAL delivers a greater level of ongoing support to customers and high-quality, relevant customer interactions. This leads to increased client satisfaction and trust, and a higher share of wallet (AuM/FuM).

Consumer Understanding

One of the four outcomes of the Duty explains the element ‘Consumer Understanding’. In a world of high inflation, increased uncertainty, lower economic growth and increased product offerings, clients’ investment decision making has become even more complex.

Ortec Finance’s OPAL solution helps banks, wealth managers and IFA’s support their customers by helping them make informed decisions about financial products and services. OPAL provides clients and advisers with the information they need, at the right moment and presented in a way they can understand. This is an integral part of creating an environment in which clients can pursue their financial objectives with tailored communications.

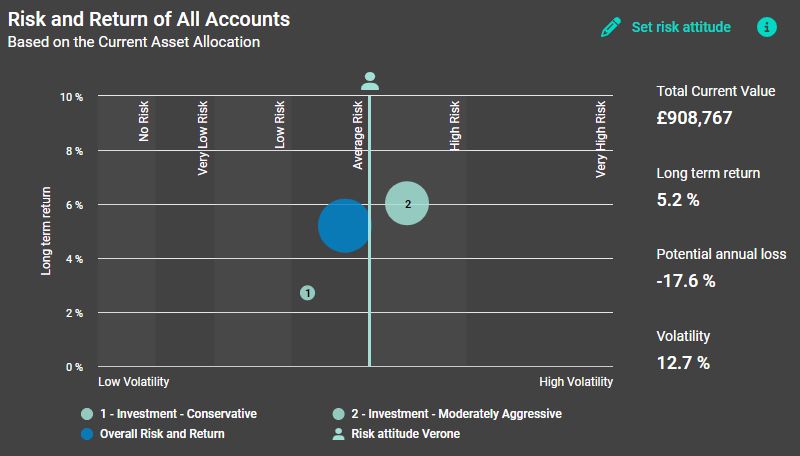

In below visual we show the aggregated risk of clients’ portfolios in relation to their risk attitude. By taking a holistic approach and visualizing the total risk of multiple investment products, clients can have a more in-depth and valuable discussion about the risks they take, enabling them to make effective, timely and informed decisions about their investments.

Delivering “Good Outcomes” to Consumers

The Consumer Duty will set higher and clearer standards of consumer protection across financial services and requires firms to act to deliver ‘good outcomes’ for customers. Firms that follow the Consumer Duty must monitor and regularly review their customers’ actual outcomes and take action to address any risks to ‘good customer outcomes’. Now, what does this ‘reviewing actual outcomes’ mean in practice, and how can it be approached?

Ortec Finance developed the ‘Suitability Framework 2.0’, enabling firms to better comply with the Consumer Duty from a risk/suitability perspective, making sure the products and services are suitable for consumers.

The ‘Suitability Framework 2.0’ aims to take a consistent approach to formulating sound advice, compliant with regulations – not just when a product is purchased but also during the term, which is also known as automated ‘suitability monitoring.' A key principle is that clients can have access to a better understanding of their financial decision making, due to the greater availability and interconnectivity of data. Also, decisions are simulated and discussed at a client level, offering more insight in outcomes than solely at a product level.

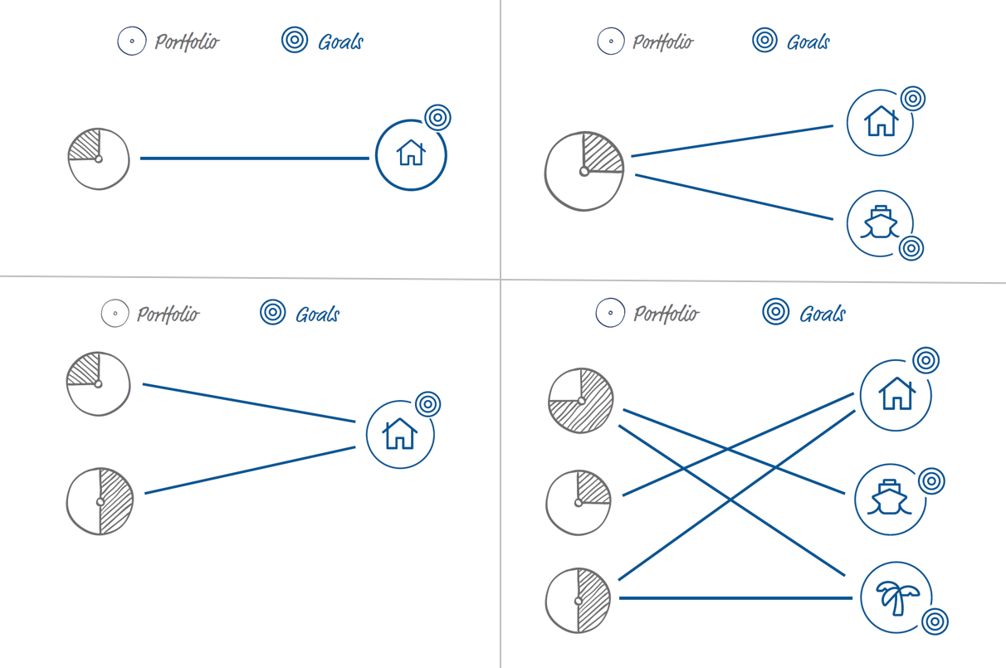

Another key principle is linking the methodology to allow for linking multiple portfolios to multiple goals, as shown in the visual. Clients often have more than one financial goal and more than one asset. Ortec Finance’s OPAL solution allows holistic advice linking one pot to one goal (mental accounting), multiple goals to one pot up to multiple pots linked to multiple goals. Based upon OPAL’s state-of-the-art wealth simulations the feasibility of each individual client goal can be determined and monitored over time.

A paradigm shift

July 31, 2023 is the Consumer Duty deadline for new and existing products or services open to sale or renewal. This date will also mark the start of a new era in financial planning and investment decision-making. Technology like OPAL can support to ensure clients receive good, comprehensive information, gain insight into risks and returns of their investments and ensure compliance with Consumer Duty regulations.

In summary, OPAL can make see to the compliance with the Consumer Duty.

- Enabling consumers

The realistic wealth projections in OPAL enable the adviser and client to analyze and assess the impact of different investments decisions on clients’ goals and decide if the risks taken are acceptable. OPAL enables the comparison of risk profiles, all tailored to the strategic asset allocations of the bank/wealth manager, leading to improved insights in the trade-off between risk and return and subsequently to better investment decisions. - Monitoring of clients’ goals

Manage your client base pro-actively and alert to when your clients are off-track to achieving their goals. Comprises the ability to filter your clients on goal priority, time horizon, goal feasibility and the current risk profile of the portfolio in relation to the risk attitude of your client. OPAL can provide automated solutions to get back on track again for those clients which are off-track to their goals. - Focus on the client, not on the product

By visualizing the total risk of multiple investment products in relation to their risk attitude, clients can have an in-depth and valuable discussion about the risks they are willing and able to take. It shows the exposure to risk in relation to their risk attitude. By visualizing this risk/return trade-off on a client-level, banks/wealth managers/asset managers/IFA’s enable their clients to make effective, timely and informed decisions about their investments. - Suitability Framework

Ortec Finance developed the ‘Suitability Framework 2.0’, aiming to take a consistent approach to formulating sound advice, compliant with regulations, which is also known as automated ‘suitability monitoring'. A key principle is that clients have access to a better understanding of their financial decision-making, due to the greater availability and interconnectivity of data, which has proven to be a challenge for many organizations.

Contact