OS-Climate Event at COP26

The Open Source Climate (OS-C) Event at COP26 focused on collaboration and the need for open source sharing of data and collective innovation. The OS-C event stressed that ‘all of us are smarter than any one of us (individually).’ How can you do open source and still meet the demands of a commercial world? How can you give things away, cooperate with others and still be commercially successful? For Willemijn Verdegaal of Ortec Finance, the answer lies in added value with your own expertise and knowledge: ‘It is all about adding value around the core innovation. For example, productize into great services and support. Ortec Finance is proud to be a member of OS-C and to be implementing this winning strategy for our clients every day.’

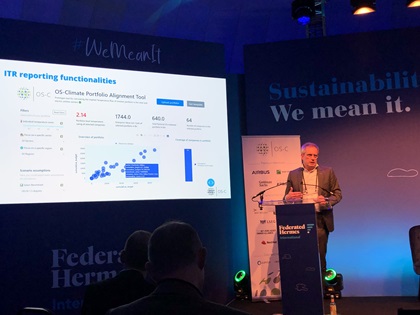

Bert Kramer of Ortec Finance presented the Implied Temperature Rise (ITR) Tool as part of the OS-Climate Alignment Tool that Ortec Finance has actively contributed to. His main message was: ‘This tool will introduce urgently required standardization of ITR methodology, while still allowing for running a variety of underlying climate scenario assumptions’. Progress on the tool was welcomed by David Blood, of Generation Investment Management & Chair of Portfolio Alignment for Glasgow Financial Alliance for Net Zero (GFANZ).

Other interesting comments of the day:

- For Fabio Natalucci, Deputy Director of IMF, the need for climate data is tantamount for investors, governments, central banks and other governmental institutions: ‘ We need climate data, whether it is about pricing climate risks, for risk management purposes, understanding financial stability via stress testing, or scenario analysis.’

- Bob Litterman, Chairman of the Risk Committee and Founding Partner of Kepos Capital asserted that physical climate-related risk are hardly priced into markets. At Ortec Finance we interpret this as confirmation that significant price adjustments in the market based on physical risk is something investors should be preparing for.

High Expectations for Financial Sector

Fabio Natalucci, deputy director of the IMF, who also commented on the urgent need for climate data, made the point earlier that he was disappointed that at the end of 2020, funds with a sustainability label totaled only $3.6 trillion USD, which represents just 7% of the total investment fund sector. Funds with a specific climate focus accounted for a ‘meagre $130 billion USD of that total’, he said.In spirit of Adaptation, Loss & Damage day on Monday, Rosanne Lam of Ortec Finance says: ‘in addition to governments delivering $100 billion on climate finance, private investors should also empower developing countries with the financial support required to facilitate the transition. Developing countries like India may only be able to meet these ambitious net zero targets with the support of developed countries to facilitate a more rapid decarbonization’.

At the Climate Action Innovation Zone, Fiona Reynolds, the CEO of the PRI stressed that ‘the financial sector needs to reshape, otherwise - many don’t realize this - there will be no more financial sector. We cannot keep living as if there are no planetary boundaries. New way of thinking needs to consider risk, return and impact. Each investment has impact, let us turn that into a positive one’.

Linda Knoester of Ortec Finance was happy with the calls for systemic change and the active role finance is taking at COP26. As Fiona Reynolds said, ‘Back in the days, the financial sector was not present at COP events or only somewhere far from the center. Finance is now front and center because of a global realization that the financial sector is needed for the transition’.

Developing Countries want Transparency

The Climate Vulnerable Forum1, a group of countries most threatened by climate has called for a ‘Glasgow Emergency Pact’ from the summit, which demands, among other things, from all countries to report annually on emission reductions. The reason for this demand for an emergency pact is that current pledges from the countries who sign the Paris agreement are insufficient. Without a drastic increase in the nationally determined contributions (NDCs), the world is heading to a temperature increase of 2.7oC, according to UN calculations.

‘The climate emergency requires an annual review, and not just every five years’, said Saleemul Huq, director of the International Centre for Climate Change and Development in Bangladesh. Under the Paris Agreement, countries are only required to increase the targets of their NDCs every five years. Which means that the next deadline is still 4 years away. Developing countries say this is much too late. According to them, countries that fail to come up with national plans on cutting greenhouse gas emissions in line with limiting temperature rises to 1.5oC must be forced back to the negotiating table every year from now on.

Four Days Left

The second week of COPs are the most difficult ones because countries and governments have to deliver. Three main topics that are still on the table and are also of great impact for investors are:- Regulations on how countries measure and report on their emissions.

- The role of carbon trading and pricing in how countries meet their commitments, under Article 6 of the Paris agreement.

- Support for (developing) countries, financially and non-financially, to adapt to the impacts of the climate crisis, and how they receive financial compensation for any impacts too great to be adapted to – known as loss and damage.

-

Contact