The global commitment towards meeting ambitious net-zero and emissions reduction goals by 2050 have been unquestionably abuzz over the recent years. Achieving these decades-long goals without an effective progress measurement and reporting framework will be tremendously challenging for any implementation pathway, even with set interim targets.

The world is now facing less than seven years to significantly reduce its emissions, compounded by the increasing risk of tipping points and growing legal scrutiny. Efficiently generating independent and comprehensive metrics to ascertain portfolio alignment against net-zero goals will be critical to implementation success.

What are portfolio alignment metrics?

Portfolio alignment metrics are forward-looking in nature and help investors measure their portfolio’s performance against the objectives of the Paris Agreement and net-zero emissions.

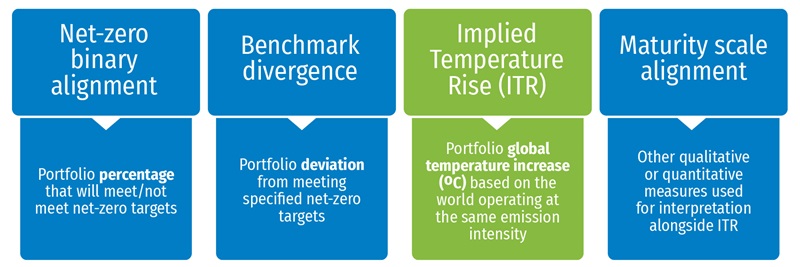

The global standard setting body, Task Force on Climate-related Financial Disclosures (TCFD) has released guidance on portfolio alignment, upon which GFANZ expanded on in their Portfolio Alignment Measurement framework. Within these frameworks, TCFD PAT and GFANZ have offered a suite of alignment metrics outlined below, of which the ITR is the most comprehensive.

Misconceptions surrounding ITR

Various ITR datasets have been developed in the market over the past couple of years by data and analytics providers utilizing different methodology without standardization, causing deviations. As illustrated in IIGCC’s Delivering Net Zero Data Catalogue, these deviations were not only limited across methodologies but also across the underlying GHG-emissions data, whereby there is also limited availability due a continuous lack of corporate disclosure. As a result of these two deviations, identical companies would generate widely-varying ITR scores between different providers, raising valid concerns from investors around its effectiveness.Despite concerns around its reliability, we believe that the ITR remains the most effective metric for monitoring net-zero implementation progress subject to it being generated with an independent and transparent measurement approach. With this approach, ITR metric will provide investors the most insightful information about their portfolio’s alignment state of play – while still being intuitive and communicable to stakeholders.

Key ingredients to a reliable ITR score

When the underlying methodology and emissions data within an ITR score are independent, transparent and free from any potential conflict of interest, it can be a trustworthy metric. This will likely hold regardless of a changing environment faced with data challenges and evolving methodology.

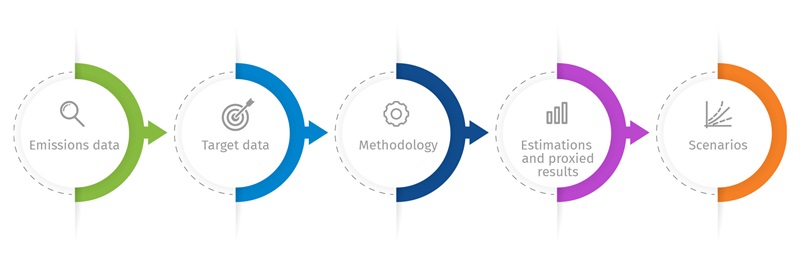

To achieve this, close scrutiny is required against the five underlying ‘gears’ driving an ITR score – all of which are critical to generating the most reliable portfolio alignment metric.

The five ‘gears’ driving an ITR score

Emissions data - How many companies are contributing to the underlying emissions data? If the number significantly exceeds 4000 (the approximate current number of companies undertaking public disclosure), it is likely there has been an estimation of emissions included.

Why is this important? This estimation (and its methodology) will significantly impact the ITR score.

Target data - Have the company targets been verified by a third party (such as SBTi)?

Why is this important? Third-party verification allows for higher data integrity.

Methodology - Is the methodology assuming all company emissions reduction targets will be fully met- i.e. the likelihood and credibility of the company meeting its target?

Why is this important? The assumed weighting of targets vs historical emissions in the ITR methodology is materially impactful. A higher weighting on the target than the emissions data has a tendency to lower the ITR score.

Estimations and proxied results - Have estimations and proxied results been included?

Due to limited publicly disclosed data, data gaps may be proxied to provide sufficient portfolio coverage.

Why is this important? If a significant amount of the portfolio is proxied then the estimation methodology will materially impact the ITR.

Scenarios - What climate scenarios are being used to benchmark the company performance? Does a net-zero world within these scenarios reflect the latest scientific research and models? Which and at what level are sectors and regions being covered?

Why is this important? Fundamentally well-researched climate scenarios used alongside comprehensive sector and region coverage will increase the reliability of an ITR score.

At Ortec Finance, we are working with the leading data-provider ESG Book and independent climate scenario-modeler Cambridge Econometrics to develop ClimateALIGN – an ITR generation tool that is independent, comprehensive and accessed via an on-demand platform.