By Ortec Finance & Cambridge Econometrics

Earlier this month the global central banking community, the Network for Greening the Financial System (NGFS1), released its third vintage of climate scenarios for forward looking climate risks assessment.

At Ortec Finance we are passionate believers in the importance of integrating forward-looking climate analysis into investment decision-making. Therefore, we applaud NGFS’s efforts in socializing, designing and making readily available top-down climate scenarios. Nevertheless, an expert critical analysis of these scenarios remains important in order to challenge modeling methodologies and assumptions. How else to progress in the field?

In our earlier article, we set out an extensive analysis of the strengths and limitations of the earlier NGFS climate scenario versions. Many of the comments made remain valid in respect to this latest update.

Key additions include:

- Increased granularity of sectors - Transport: Freight and Passengers, and Industry: Cement, High-value chemicals, Non-ferrous metals, Steel and Others

- Physical risk GDP losses have been doubled. GDP losses from chronic physical risks reach more than 6% in 2050, and up to 18% by the end of the century in the Current Policies scenario.

- Acute physical risks (cyclones and river flood) are now included but only translated to GDP.

These changes have resulted in quite different impacts from the earlier version. For example, the shock to equity is materially larger.

However, our team at Ortec Finance, in collaboration with macro-modeling experts at our partner organization Cambridge Econometrics, remain concerned.

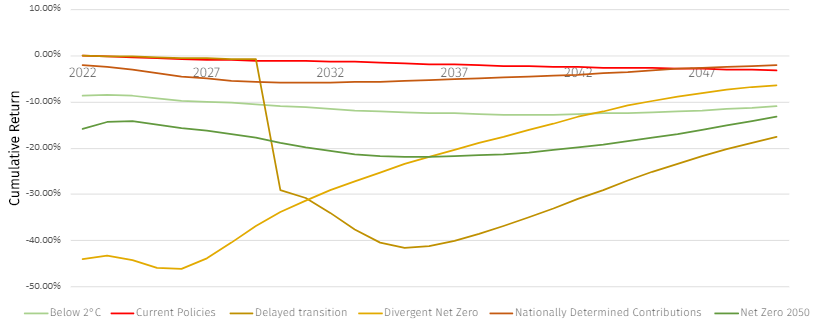

When looking at US equity performance across the 6 NGFS scenarios on a 30-year horizon, the Current Policies and the NDC scenarios show the best performance. They strongly outperform all the other 2 degrees and Net Zero scenarios. This is a harmful message and not a credible one. It points towards a continuing underappreciation of physical risks, and omission of likely market pricing-in and market volatility dynamics and modelling choices.

Figure 1: Cumulative returns of US equities across NGFS climate scenarios

The points below explore the NGFS’s climate scenario limitations in more detail:

- Physical risk modelling remains problematic. The literature used as a basis for NGFS slow onset event modelling is one of the most optimistic in its field . NGFS assumes physical risk to be linear, therefore completely side-stepping the issue of non-linear feedback loops and tipping points. Regarding the extreme weather modelling, a first step has been made, but effects have not yet been translated to financial impacts.

- No market risk considered. The financial impacts shown in the NGFS scenarios capture only direct impacts and how they are expected to unfold in the real economy. They do not include a climate scenario narratives layer on how financial markets may react to transition- and physical risks materializing in the real world. Inclusion of market pricing-in dynamics and/or market sentiment shocks can significantly change the time horizon in which climate-related risks or opportunities become material to a portfolio’s risk and return implications.

- Macro-model choice. Even though the NGFS states that it reflects ‘the uncertainty inherent to modelling climate related macroeconomic and financial risks’ the NGFS scenarios only look at general equilibrium model results. Non-equilibrium models - which are models recognised for being better suited to capture the dynamics of economies in transition – have not been considered. For more information on equilibrium vs non-equilibrium models please refer our publication in The Actuary magazine here.

In addition to the main points above, the scenarios are rife with inconsistencies and unclarities we cannot bring home. A couple of examples:

- Carbon prices are lower in Phase 3 transition scenarios compared with Phase 2 – in 2050 the carbon price in the previous Delayed transition scenario reaches over USD (2010) 600 t/CO2 while it approaches USD (2010) 400 t/CO2 now. Without further information it is unclear how temperature outcomes are maintained while policy ambitions are dialled down.

- The global CO2 emissions trajectory in the Current Policies scenario is almost flat between now and 2040, which is highly unlikely given a strong economic growth and a relatively weak set of short-term decarbonisation policies currently implemented.

In view of the above we would recommend that the NGFS:

- Reflect on the danger of the overall messaging delivered via these climate scenarios that are likely to be widely accepted and used by financial institutions around the world. Do Central Banks really intend to signal complacency when it comes to portfolios’ climate risk exposure?

- Reassesses the appropriateness of its slow onset physical risk modelling to ensure that it better reflects the full range of uncertainty.

- Supply detailed narrative descriptions of the scenarios to correctly understand, interpret and apply the scenarios in business and financial analyses and nuanced decision-making.

- Provide sensitivity analysis of the scenario results to provide insights into the key assumptions that move the dial on reaching low carbon outcomes.

1 The NGFS scenarios are based on a climate related damage function estimated by Kalkuhl, M. & Wenz, L.: The impact of climate conditions on economic production. Evidence from a global panel of regions. J. Environ. Econ. Manag. 103, 102360 (2020). There is a wide range of publications on the estimation of climate related damage functions, all of which provide a lower bound of likely damages due to methodological and data constraints (eg. no climate tipping points taken into account), but among those, the Kalkuhl & Wenz (2020) provides a relatively small damage estimate. We think the Burke, M. and V. Tanutama: Climatic Constraints on Aggregate Economic Output, Working Paper 25779, National Bureau of Economic Research, April 2019 provides a better estimate, which also implies larger economic damages due to temperature rise. A good literature review with cross-comparisons is provided by Piontek, F. at al.: Integrated perspective on translating biophysical to economic impacts of climate change, Nature Climate Change, Vol 11, July 2021.

Learn more about our Climate Scenario Analysis Solution - ClimateMAPS

Contact

Bronwyn Claire

Climate Science Lead, Climate & ESG Solutions