The efficient representation of liabilities is crucial for insurance companies to determine a robust Strategic Asset Allocation (SAA) strategy. However, simulating insurance-related liabilities across a range of economic scenarios can be quite challenging due to the complexity of some insurance products. This blog post explores three approaches to measuring the impact of liabilities on SAA: actuarial simulation, replicating portfolio, and product-based dynamic liability modelling. It also compares the advantages and disadvantages of each approach in terms of accuracy and runtime efficiency, highlighting the benefits of a dynamic liability modelling approach as a fast, flexible, and efficient solution for multi-scenario SAA analyses in a full ALM context.

Actuarial simulation model

One approach is to use the insurer’s actuarial pricing and valuation models for projecting their liabilities. Given that these models are already used for pricing the product policies under different economic and actuarial circumstances, means it could also be used for creating accurate projections given certain scenarios.Since actuarial models can work with individual policies and their corresponding actuarial inputs, such as mortality tables, lapse expectations, unemployment probabilities, etc., the dynamics these models can capture are vast.

The disadvantage is that these models are inherently complex and therefore require long simulation run-times and resources. Valuation of options and guarantees, for example, require nested simulations that require a lot of resources and take days to calculate. Stochastic SAA studies require fast and efficient models in order to simulate multiple runs and perform iterative analyses that are generally conducted on thousands of scenarios. This makes an actuarial simulation model an unviable approach for performing analyses in a full ALM context.

Replicating portfolio approach

Another possible approach for capturing liabilities in ALM context is to use a replicating portfolio. The replicating portfolio is a collection of assets that collectively display the same kind of behavior under a range of economic scenarios, as the liability it tries to replicate. Typically, one focuses on characteristics like; the cash flow profile (incl optionality), duration, (il)liquidity and credit quality.

The advantage of this approach is that it is relatively simple to implement and faster than the actuarial model. Once a suitable portfolio of replicating assets has been found, they can be easily valued by using traditional valuation methodologies based on corresponding interest rate term structures available in each scenario. Also, embedded options and guarantees, at least the non-exotic ones, can be valued by using bonds and equities and their derivatives, as part of a replicating portfolio.

The downside is that replicating portfolios are, at best, still only an approximation of the liabilities. This is mainly due to the fact that the assets necessary for the replication are rarely an exact fit to the liabilities. Furthermore, market data is scarcer for higher maturities, which makes it difficult to replicate longer-term liability cash flows. Other issues are transaction and management costs that arise when maintaining or constructing the replication. Lastly, the replicating portfolio does not reflect the actuarial basis of the liability, which makes it difficult to take account of sensitivities of actuarial parameters, such as lapse behavior or changes in mortality.

Dynamic Liability Model

A third method that tries to combine the benefits of both aforementioned models, is a dynamic liability modelling approach. Here, best-estimate cash flows of premiums, benefits/losses, costs and, if applicable, other product-related cash flows are used as a basis for the dynamics of liabilities. These base line cash flows are derived from the actuarial model and includes aspects, like mortality and lapse assumptions.

The best-estimate cash flows are then linked to product-specific parameters, such as new business profitability, crediting rate, and optionalities or guarantees, etc. This allows the scenario dependent scaling of liability cash flows, which would closely match the results of the actuarial system, when fed with similar scenarios and assumptions.

Where the actuarial model is too complex and too slow for SAA analyses, and the replicating portfolio forms an oversimplification from an actuarial point-of-view, the dynamic liability modelling approach finds a perfect trade-off between the two. This approach is fast, flexible, and capable of taking policy-specific dynamics into account, making it an efficient solution for multi-scenario SAA analyses in a full Asset Liability Management (ALM) context.

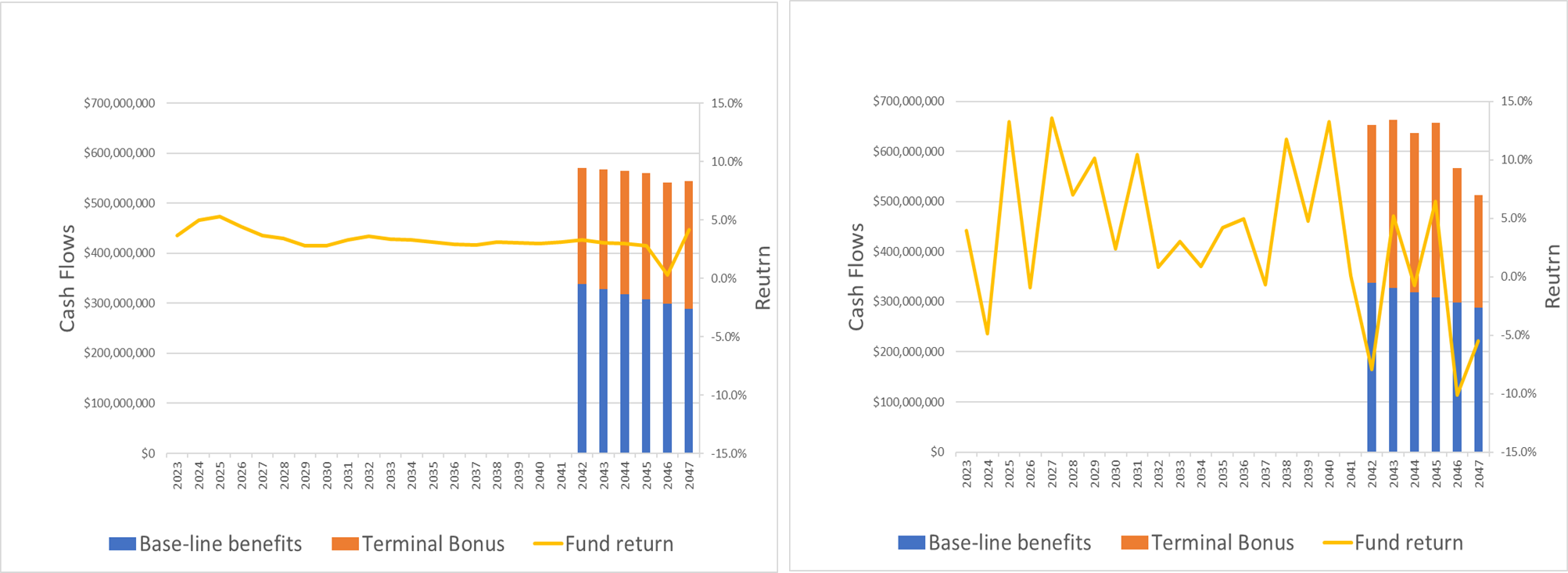

Box 1: An average scenario versus a volatile scenario for a profit-sharing product with 6 cohorts modelled with the dynamic liability modelling approach. On top of the base-line benefits, a scenario-dependent terminal bonus is added.

Whichever strategic asset allocation model you use for your portfolio strategy, one which emphasizes diversification to reduce risk and improve portfolio returns is key. If you want to know more about our ALM platform GLASS for insurance, contact us today for a demo.

Contact