As we enter New York climate week – one thing is certain – the US discourse around climate change is as fraught as ever.

Climate change & ESG, once a topic relegated to the bottom of the political agenda, has now taken center stage. In some conservative states such as Texas and Florida for example, state pension funds are no longer allowed to invest in initiatives that are ‘hostile’ to the fossil fuel energy sector or are prohibited from integrating ESG criteria into decision making. Nevertheless, at Ortec Finance we are of the view that such considerations about climate and ESG will be an inherent part of institutions in the future. We would even go so far as to openly wonder if what we are seeing in the states of Texas and Florida are the last desperate attempts to stimy the inevitable; a transition to a low carbon economy.

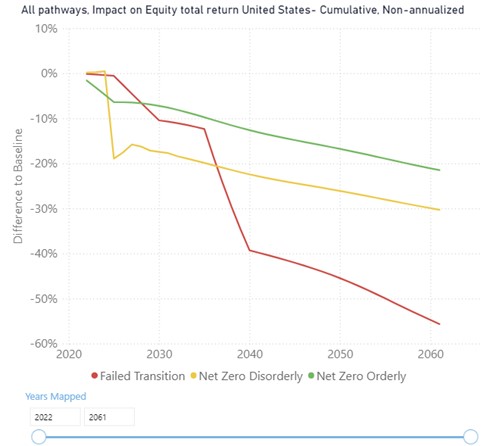

The US stands to both lose and gain considerably from a transition to a low carbon economy. Due to its geography, it is vulnerable to physical climate related risks including heatwaves, hurricanes & wildfires. Therefore, preventing further warming is crucial for the US to ensure safety and economic prosperity. Even in a best-case scenario (see Figure 1 below) – one where the world transitions to net-zero by 2050 in an orderly fashion, some physical risks are already locked-in and will take their toll sending US equities down by about 20% on a cumulative basis by 2060. In a more pessimistic scenario, 4 degrees Celsius ‘Failed Transition’, this number could increase to nearly 60%.

Near term, a disruptive transition poses the largest risks to investors. The US, being a net fossil fuel exporter, is amongst the most severely impacted countries in the world if domestic and global demand for fossil fuels were to suddenly disappear. Considering the latest developments, it just may…

After two years of negotiations, the Biden administration managed to pass the Inflation Reduction Act (IRA); a historic legislation that allocates $369 billion towards climate action. Although there is still ways to go to put the US on a net-zero trajectory, it is a significant step in the right direction – reducing emissions by roughly 40% from 2005 levels (for a net-zero trajectory it would have to be circa 70%).

Figure 1: US listed equity valuation scenarios across three climate pathways in cumulative, non-annualized terms over a 40-year horizon. Results show the difference from a baseline that does not take climate related risks explicitly into account.

The financial modelling paints a grim picture for the fossil fuel reliant energy industry and those that have significant exposures to it. Instead of committing to soon to be antiquated means of producing energy, investors may wish to devote their resources to accelerating the transition. They would be increasing their chances of benefiting from the financial gains that innovation and technological change have to offer. Instead of ‘divesting’ from ESG – investors may want to proactively engage with it.

Learn more about our Climate Scenario Analysis Solution - ClimateMAPS