Innovation in goal-based planning

Over the past couple of years, public awareness of Climate Change and Global Warming as a systemic risk for our society has increased. In its recent publication, the Financial Stability Board states that climate-related risks “may give rise to abrupt increases in risk premia across a wider range of assets” and that “this could alter asset price (co-)movement across sectors and jurisdictions ”. From a retail wealth industry point of view, this has sparked significant client demand for sustainable investment products. Multiple consultancy firms observe and predict that the interest from retail investors in sustainable products will continue to grow and that its allocation may even double over the next 5 years. While institutional investors are already incorporating the risks and opportunities of Climate Change into their policies, this is still barely the case for retail investors and their advisors. How may the potential consequences of Climate Change affect the perspective on expected rate of return? And how does this perspective impact decision-making for retail investors?Climate Change What-if Analysis

The core purpose of our goal-based planning solution is to support the decision-making process of retail investors so that they can confidently choose an investment portfolio that best aligns with their financial goals. In order to do this we use forward-looking projections of their portfolios’ risk and return characteristics, based on their underlying asset allocation. While these projections always aim to reflect the most realistic forward-looking view of what may happen in the future, advisors and their clients can stress-test these decisions through what-if analysis. For example; What if the economic reform required to stabilize global temperature increase to 2.0 oC, strongly affects economies and financial markets? How structured and orderly will this transition take place? What if this transition never happens? Ortec Finance has now developed an economic outlook, which includes the impact on expected risk and return of asset classes for three potential transition pathways for what-if analyses.Why is this important for Retail Investors?

Our research shows that, in general the expected rates of return of investment products could be significantly lower when accounting for the potential impact of climate change. At first glance from a commercial perspective, having a less optimistic growth expectation of a client’s portfolio may not appear to be an attractive proposition. . However, from an advice perspective, these deep insights into potential outcomes of a portfolio add additional value to the client’s personal investment decisions and ability to realistically meet their long-term goals. Consider the following example: Client A has a goal to have at least $500,000 when she retires in 15 years’ time. Based on her current situation, her advisor recommends that a Conservative portfolio is most likely to meet this goal, based on an expected rate of return of 3.5%. However, when her advisor takes into account the physical and transition related impacts of climate change, the expected rate of return of this portfolio may be only 2.75%. As a result, the clients’ goals are not met. Therefore, the advisor may wish to recommend an increase in her periodic contributions or opt for a riskier portfolio with a higher expected rate of return.Benefits of Sustainable over Traditional Portfolios

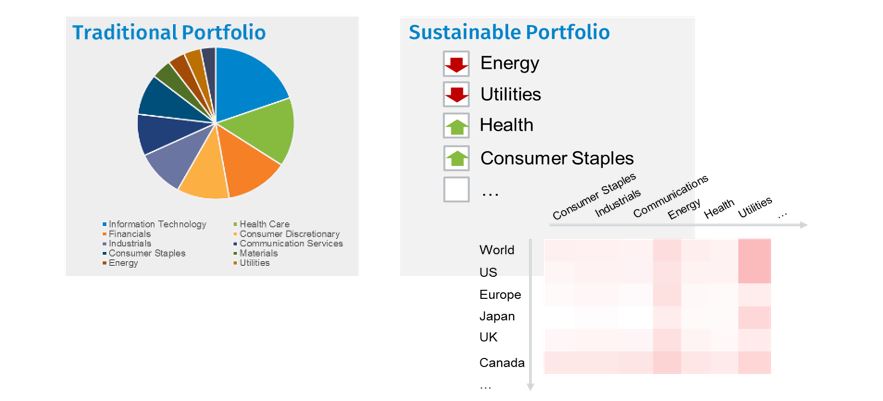

Climate-related financial risks and opportunities affect all regions, sectors and asset classes. Therefore, we consider it prudent to include these risks and opportunities in all forward-looking wealth management services.After this first step, an advisor may, as a next step, wish to consider low- carbon, ‘green’, or sustainable investment products to further mitigate risks and boost return. ‘Green’ products may positively contribute to preventing climate change, they may also lead to better expected outcomes for the client. Consider a client who has the option to choose between a traditionally managed equity portfolio, e.g. one which has the MSCI World as a benchmark, versus a sustainable equity portfolio, whose manager deliberately excludes non-sustainable companies from their portfolio. As a consequence, the sustainable portfolio will have a significantly different region and sector allocation compared to the traditional portfolio. In the what-if analysis, and depending on the climate change scenario chosen, the advisor can quantify the benefits of such a portfolio in terms of expected rate of return. Climate informed risk-return management is taking place at two levels: 1) the underling scenario 2) at the product level.

Help clients to make Climate-Aware investment decisions

Retail investors are increasingly demanding a higher service level and value-add from their bank, wealth manager or investment advisor. Following in the footsteps of the institutional market, it is now time for the retail wealth industry to also consider how climate change affects their clients’ investment decisions. Making use of a what-if analysis that fully integrates climate risks and opportunities into their economic outlook is key to effectively help clients to make better investment decisions. Both from a high-level investment plan perspective and from the perspective of what particular – sustainable – investment products to buy.Click here for our previous blog on boosting the added value of advice with goal monitoring or visit our Goal Based Planning Solution page if you would like to learn more about our current offering for goal-based planning and monitoring.

__

[1] The Implications of Climate Change for Financial Stability, Financial Stability Board, 23 November 2020

[2] E.g. Oliver Wyman Wealth Management Report 2020, Track Insight 2020 Global ETF Investor Survey and a survey conducted by AIMA and KPMG amount 135 institutional managers, hedge fund managers and portfolio managers.

Contact