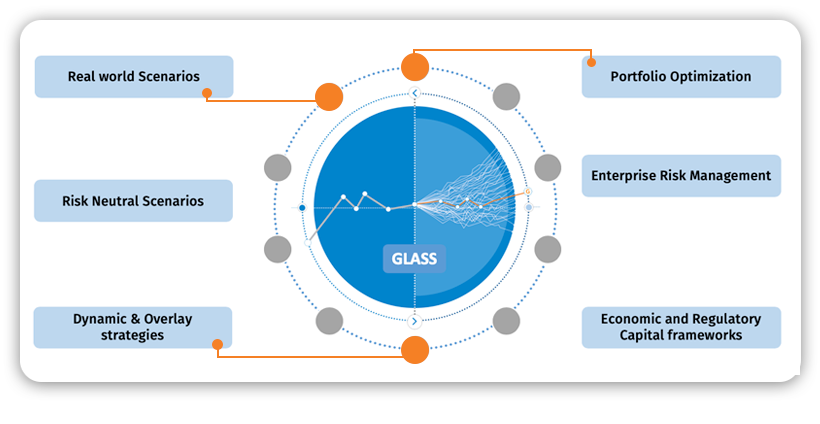

GLASS enables decision makers to understand the risk and return consequences of management actions based on a total balance sheet approach. It facilitates the Enterprise Risk Management process in an integrated way, from ALM analyses to strategy evaluation, including multi-period SAA optimizations. GLASS provides efficient insights with respect to your Capital Risk Management framework, your business and investment policy, backed by flexible reporting and analysis.

For more information download our GLASS for Insurance brochure

Contact

Hamish Bailey

Managing Director UK, Head of Insurance & Investment