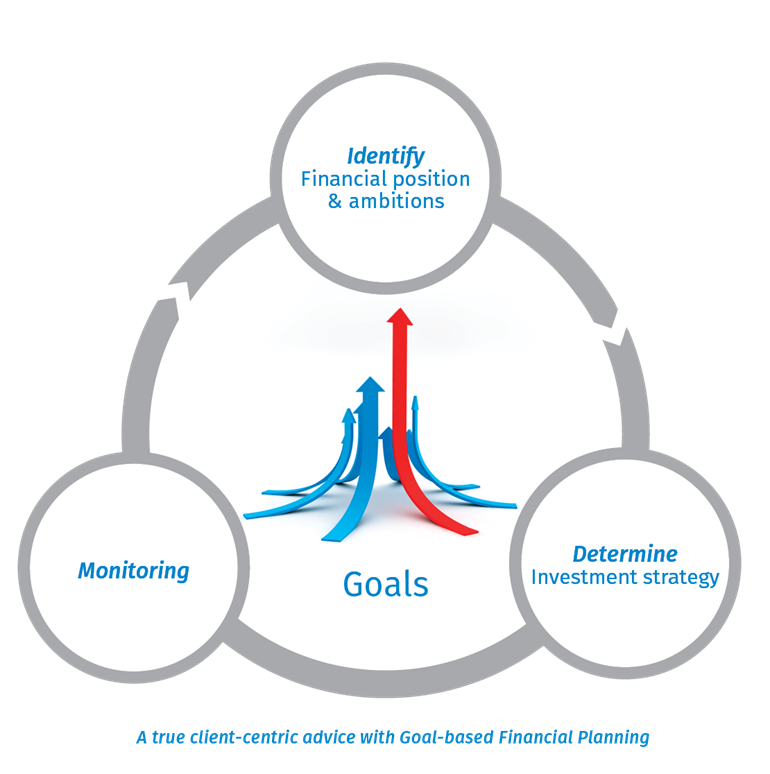

Why do your clients invest? What ambitions do they seek to fulfill with their assets? Does the current investment portfolio optimally fit your client’s ambitions and appetite for risk? Questions like these get to the heart of Goal based Financial Planning: to make ambitions tangible, to translate them into an optimal investment portfolio, and to monitor whether your client stays on track to reach their financial goals. The result is a client-centered approach, that fully aligns the product profile with the client profile.

Identifying goals

Goal-based Financial Planning begins with identifying goals. What do your clients want to achieve? Why do they invest in the first place? Some goals are very clear, such as financially supporting one’s children, or creating additional pension income. But compensating for inflation, in order to maintain an existing standard of living, can be a goal as well.

If you are familiar with your client’s goals, you can determine which financial assets will be needed in the future to realize each specific goal. You can help your client to better understand their financial planning options, and indicate when funds should become available. Cash flow analysis can be a valuable method to provide this information and to indicate possible shortages. Research shows that people who invest often have more than one goal. If this is the case for your clients, it is recommended to establish what priority they give to each of their goals. This will help them make the right decisions, even if their financial situation develops differently than expected.

When you advice clients on their financial situation, it is important to walk them through this process. For you as an advisor, the construction of a suitable portfolio starts with answering the following questions:

- What are the goals of your client and how important are they?

- On what time-scale does your client want to achieve these goals?

- And, finally, how much money will your client need to do this?

Investment decision support

When ambitions are sufficiently concrete, the next step is to find the optimal investment portfolio. Goal-based Financial Planning supports investors in determining an investment strategy that optimally contributes to the realization of investment goals, and that also aligns with the investment risk that the investor is comfortable with. Its strength lies in the combination of short-term and long-term insights. In the current advisory practice, one often selects a secure risk profile based on the short-term risk of an investment portfolio. The short-term risk is the volatility (or the fluctuation in value) of the investments over a one-year period. This means that investment decisions are made based on short-term developments, whereas the goals that must be realized often lie much further into the future.

"In a few years’ time, we all have a personal client portal that guides us in all our financial decisions."

To select a suitable investment portfolio, one needs information that provides insight into the risks in the short and long term. Goal-based Financial Planning informs you of both types of risk. The long-term risk is mapped by calculating the feasibility of investment goals. This risk often goes unmentioned, but is of decisive importance to many investors. The long-term risk shows how realistic the expectation is that you will reach your goals, given your financial situation and investment strategy. And it paints a picture of the potential consequences, if things go differently than you expected.

Contact