OPAL Planning provides forward-looking insights into whether clients are on-track regarding their investment objectives. Together with a fully integrated cash flow planning tool for a holistic view on the client situation, the tool addresses both income and investment risk.

About OPAL Planning

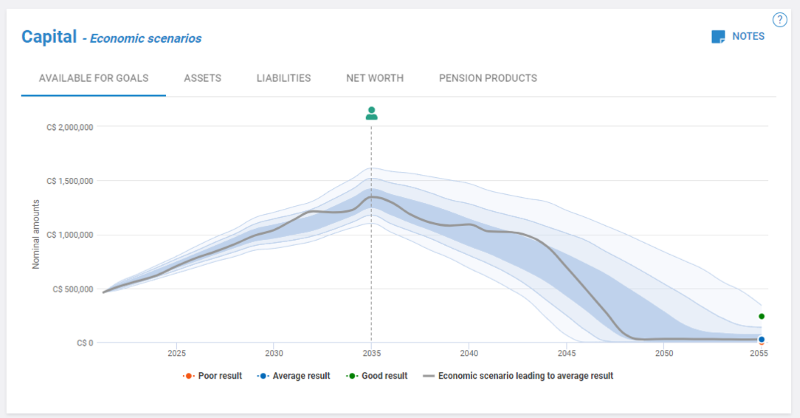

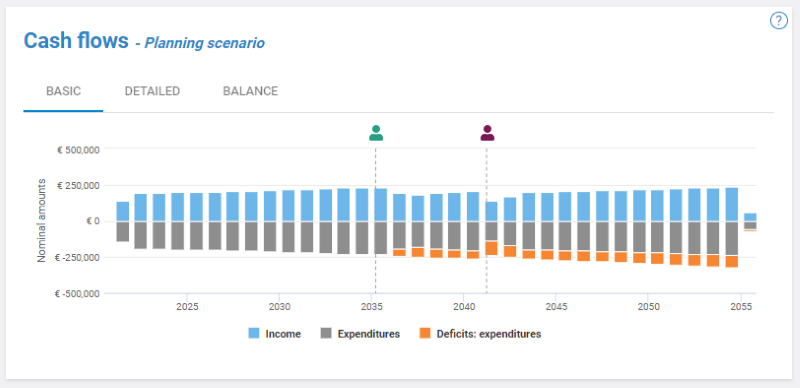

OPAL Planning uses realistic portfolio projections of institutional quality, based on monthly updated economic scenarios for more than 700 asset classes, which can be linked to client financial goals. Additionally, OPAL Planning offers a fully integrated cash flow planning to enable easy identification of possible budget shortfalls or surpluses, which supports efficient decisions. OPAL Planning differentiates itself from all other financial planning tools by integrating the effect of investment risks on the realization of expenditure goals. OPAL Planning can be deployed through three different modules:

-

OPAL Wealth Planning & Monitoring

Supports advisors with MiFiD II compliant product advice related to suitability and appropriateness -

OPAL Retirement Planning & Monitoring

Enables enhanced product advice, through a holistic overview of a client’s financial situation based on an integrated cash flow plan -

OPAL Financial Planning & Monitoring

Provides additional functionality with further insights into life events such as early death.

Available as plug and play UI or flexible REST API

OPAL Planning can be deployed as a plug-and-play user interface that supports advisors to efficiently support their client base with Goal-Based Planning and/or Retirement Planning. The application can be linked to external data sources, supports single sign on and the look and feel can be adjusted to provide a seamless experience for the user.

OPAL Planning is also available as a high speed REST API, which enables organizations to implement the capabilities directly into existing platforms or client-facing web applications, e.g. to support robo-advice client journeys, hybrid advisor experience or other technology platforms such as CRM, Portfolio Management or Financial Planning software.

Features

-

Forward looking portfolio projections

-

MiFiD II compliant product advice

-

Linking multiple accounts

-

Fully integrated cash flow

-

Advisor Dashboard

Forward looking portfolio projections and insights into risk and return based on more than 700 global asset classes.

Supports advisors with MiFiD II compliant product advice related to suitability and appropriateness.

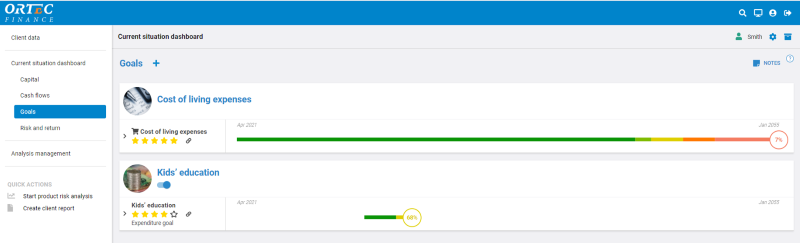

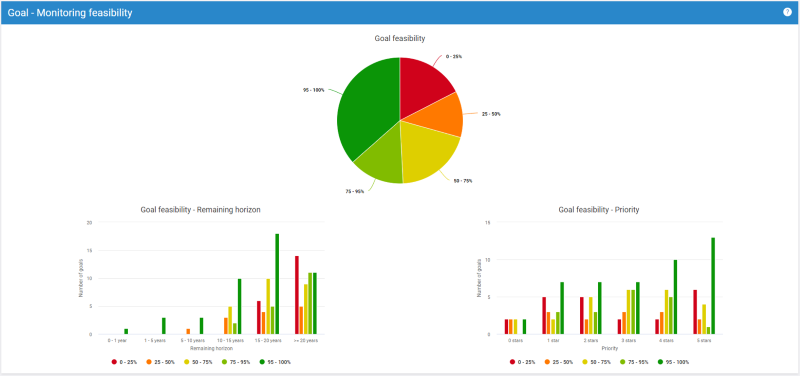

Linking multiple accounts to multiple goals and insights into feasibility of client goals.

A fully integrated cash flow module that can be localized for pensions, products and taxes, with proven solutions in the UK and the Netherlands.

Advisor Dashboard with daily updated monitoring for signaling off-track client goals.

Discover our solutions for this industry

-

Goal Based Planning

Translate client financial goals into an optimal investment strategy that reflects their personal ambitions, cash flows and risk appetite and monitor the progress over time.

-

Retirement Planning

Enable clients to fund their lifelong retirement expenses through an integrated accumulation and decumulation strategy or discover options such as early retirement or other financial goals.

For more information download our OPAL leaflet by filling out the form.

Contact

Mark Glover

Managing Director – Head of UK Wealth Management